A family-owned group founded in Paris in 1961, OCIM is active across the entire precious metals value chains.

Over time, its teams based in Paris, Geneva and Lima have developed complementary expertise in the physical and financial trading of precious metals, in the compliance and due diligence challenges of the ASM sector and in the operational realities on the field.

This expertise gives OCIM a privileged role in bringing together the previously distant expectations of the various players in the industry and in creating integrated, responsible and traceable supply chains.

Such a mission statement is deployed through a wide range of activities in the precious metals value chains, from small producers to intermediary refineries and aggregators to LBMA refiners seeking responsible supplies of material.

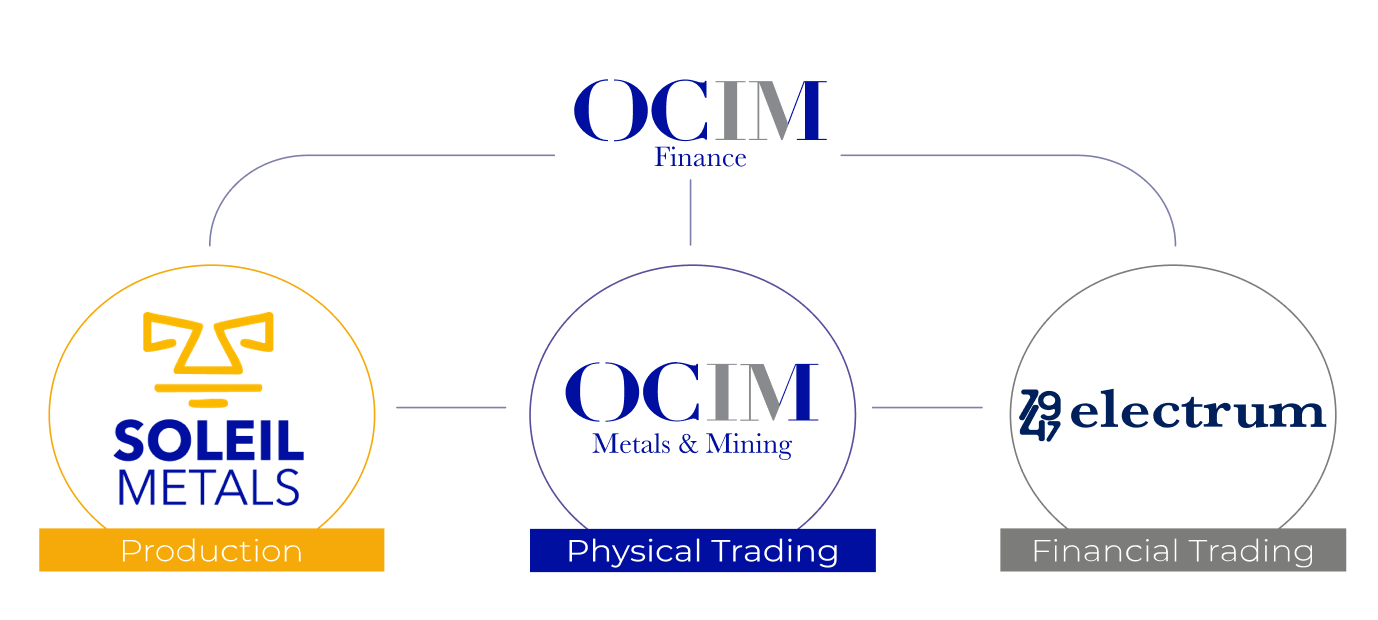

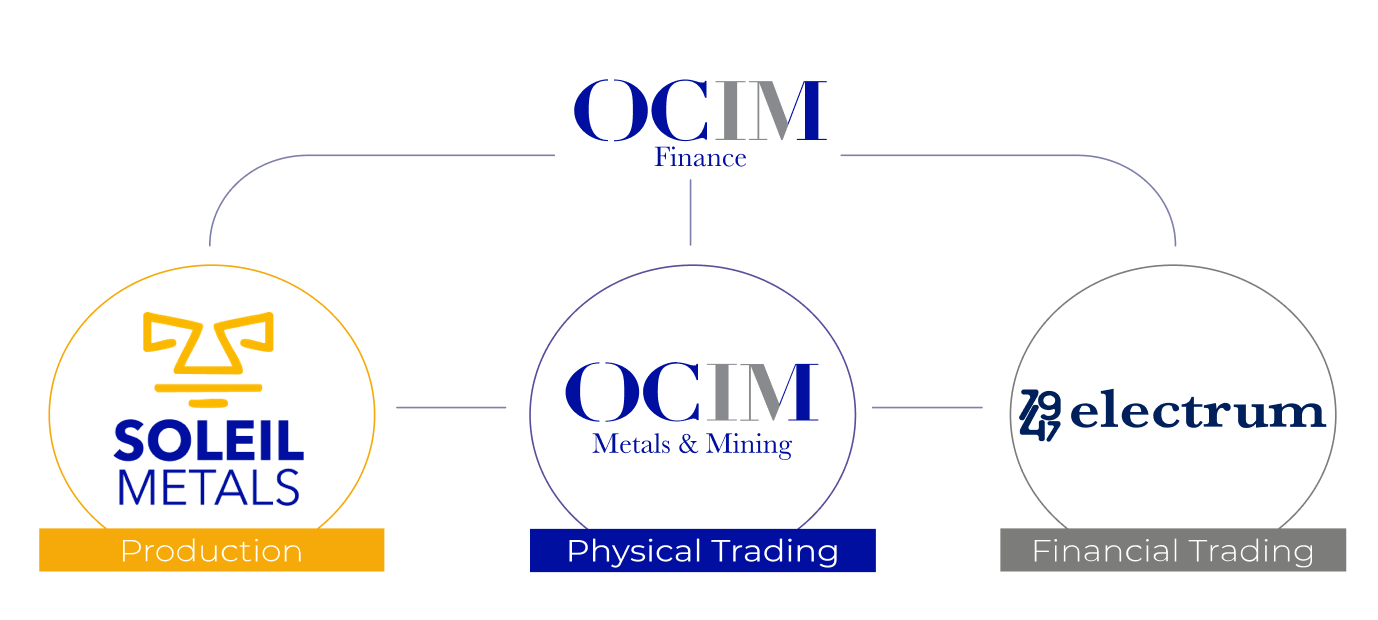

OCIM group is composed of three Business Units. Each of these entities is owned by OCIM Finance, the group’s holding company, which defines the strategy, organizes the activities and provides services, such as financial management, human resources and communications, to its subsidiaries.

Soleil Metals SA operates two processing plants, Soleil One and Soleil Two, located in the south of Peru and duly authorized by local authorities. Soleil Metals plants source gold and silver ore from formalized and vetted ASM miners and sells its production of doré bars to European LBMA accredited refineries. Such a field capacity as an intermediate refinery and as a gold producer brings a unique insight for both the trading and funding activities of the OCIM group.

OCIM Metals & Mining SA is mainly engaged, thanks to its regulatory expertise, in the business of setting up offtakes with responsible ASM supply chains, from the source to LBMA refiners and end users. Whenever possible, OCIM Metals & Mining also provides short term working capital financing to upstream actors by way of advance or provisional payments. OCIM Metals & Mining absorbs the OCIM group credit risks when providing funding to external counterparties.

Electrum SA is an independent market participant in FX and commodities trading on all the main markets, acting as the the financial trading division of the OCIM Group. Electrum’s highly experienced team implements discretionary and systematic trading strategies on global capital markets, from metals and energy to G10 currencies. We ally field knowledge and sophisticated quantitative models to extract value from the best combination of technology and human capital. Electrum absorbs the OCIM group financial market risks with a proprietary trading expertise, notably for hedging purposes.

What makes us different?

Vertical integration across the entire value chains, from producers to end-users

Complementary nature of our activities, ranging from producing to purchasing precious metals, to physical and financial trading

Comprehensive downstream network with refiners, end-users, financial institutions and top tier industry associations

Over 60 years in business

-

1961

Founding of OCIM, specializing in real estate development.

-

1990

Diversification into alternative assets including gold

-

2015

Next generation taking over leadership of the OCIM group

-

2019

OCIM fully dedicated to trading the precious metals value chains

-

2022

Launch of Electrum, a financial trading

entity focused on commodities & FX

-

2025

OCIM completes its vertical integration by becoming a gold & silver producer

OCIM is led by top level executives who combine strategic vision, industry expertise and hands on operating capacities.