OCIM Compliance Framework

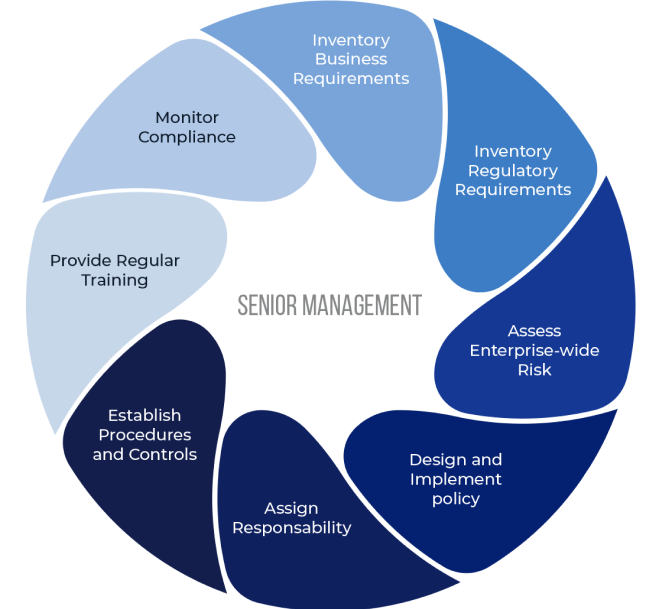

At OCIM, we are dedicated to maintaining the highest standards of risk management and compliance across the entire precious metals value chain. Our commitment to responsible sourcing ensures strict adherence to international regulations, including OECD guidelines and LBMA/LPPM standards. Through continuous monitoring, comprehensive risk assessments, and rigorous measures, we ensure ethical sourcing and financial security. OCIM is regulated as a financial intermediary in Switzerland and is subject to anti-money laundering (AML) regulations, including an annual audit to ensure compliance with the highest industry standards. With a strong focus on integrity and sustainability, OCIM reinforces trust in the global metals market, enabling all stakeholders to operate with confidence while maintaining the highest ethical and legal standards.