Silver, a class of it’s own

As one of the seven metals of antiquity, silver played a pivotal role throughout human evolution.

Like gold and copper, silver occurs in the elemental form in nature, and it was used as one of the first primitive forms of money. Over time, as knowledge and technologies evolved, silver lent itself to a vast number of industrial and other applications. Today silver is valued as both a precious metal and a store of value, but also as an industrial metal with ever-so growing number of applications.

Silver as an Investment and Store of Value

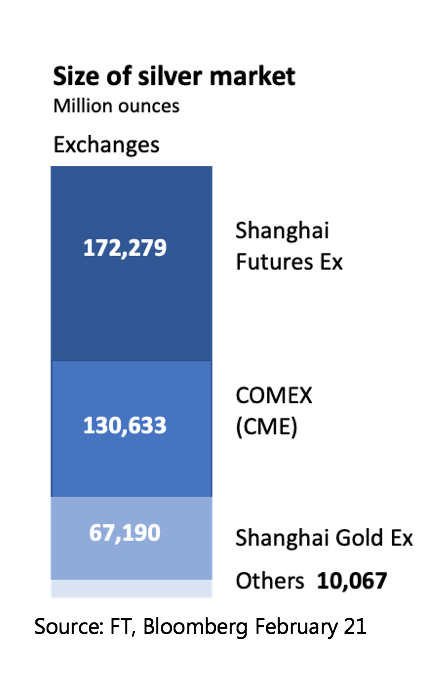

With an average US$29bn traded daily across exchanges in New York, Shanghai and between banks in London the silver market is one of the largest and most important financial markets in the modern economy. Given its size and liquidity, silver is clearly an investment asset, while not as valuable as gold and sometimes it is referred to as a “poor man’s gold”.

Silver has been regarded as a form of money and store of value for more than 4,000 years, although, when the use of Silver Standard came to a final end in 1935, it lost its role as legal tender in most countries. The relationship between silver and gold dates back thousands of years. The first Egyptian Pharaoh, Menes, stated that one part gold equals two and a half parts silver. This was the first reference to gold : silver ratio, which was to become an important determinant of gold and silver pricing and future trends. Over the past 40 years, the average gold : silver ratio has been around 55. When it takes less ounces of silver to purchase an ounce of gold, it can be assumed that silver is expensive relative to gold on an absolute value basis. The gold : silver ratio achieved an all-time-high of 127 in March 2020, which was 27% higher than the previous record seen in the early 1990s.

A traditional way of investing in silver is by buying actual bullion bars, which could be of a different size and quality with most common being the 99.99% pure or “.999 fine” – 1,000oz troy silver bars, known as COMEX and LBMA good delivery bars. Another popular way of investing in silver is buying silver coins and rounds. Silver coins are typically the one ounce 99.99% pure silver coins such as Canadian Silver Maple Leaf or 99.93% pure American Eagle. A cross between bars and coins are silver rounds, produced by a huge array of mints. Rounds have no status as a legal tender.

Another form of investment in silver are silver derivatives, such as silver futures and options. They trade on various exchanges around the world, the biggest and most liquid being the Shanghai Futures and Shanghai Gold Exchange in China and COMEX (Commodity Exchange) in the US.

A relatively recent invention, silver exchange-traded products are physically backed investment vehicles that are traded on the major stock exchanges including London and New York. Most common products are exchange traded funds (ETFs). Since the emergence of silver backed ETFs in 2006, they become a significant factor in the movements of price of silver. iShares Silver Trust, launched by iShares is the largest silver ETF on the market with over 340Moz of silver in storage, which is the equivalent of approximately one third of the world’s total annual silver production.

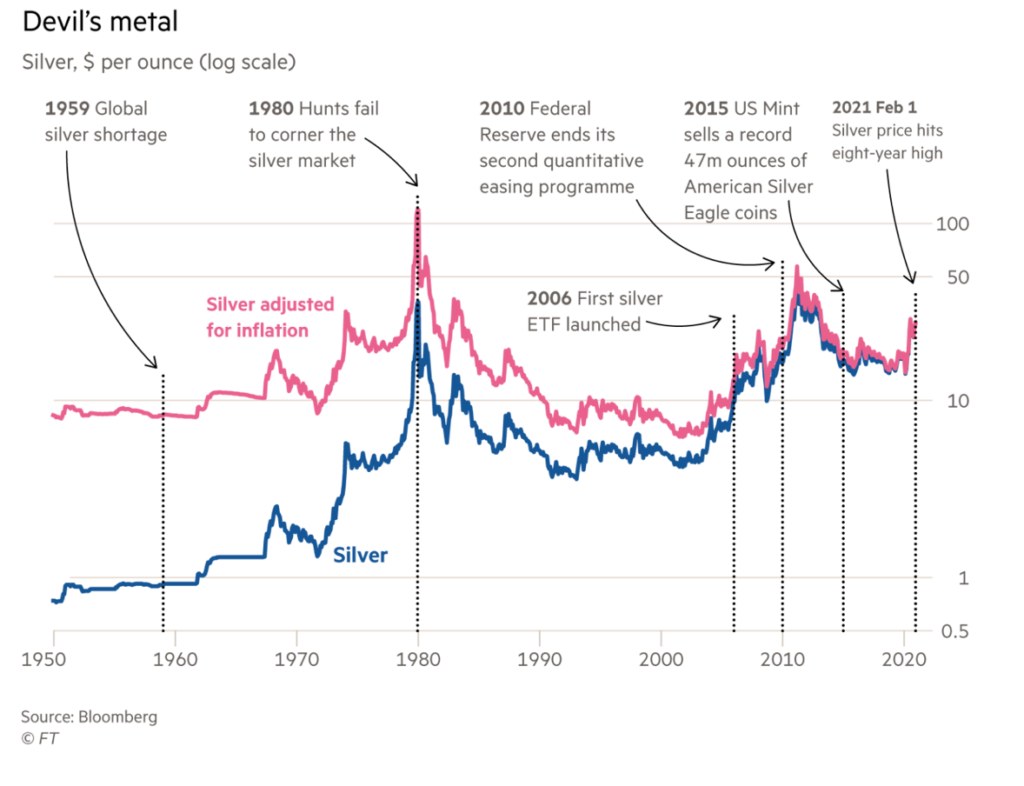

Wild swings in the silver price led to its reputation as the Devil’s Metal

The price of silver is driven by speculation and supply and demand balance, like with most commodities. It can be notoriously volatile compared to that of gold, because of the smaller market, lower market liquidity and demand fluctuations between industrial and investment uses. Because of its occasional wild swings, silver is also known as the Devil’s Metal. It is also more prone to market speculations, such as the Hunt Brothers attempt to corner the market in the late 1970s.

From 1973, the Hunt Brothers began to accumulate silver positions, which were to become one of largest private holdings of silver in the world. In the last nine months of 1979, the brothers were estimated to be holding over 100Moz of silver and several large silver futures contracts. A combination of changed trading rules on the New York Mercantile Exchange and the intervention of the Federal Reserve put an end to both their holdings and their potential for profit. By 1982, the London Silver Fix had collapsed by 90% to US$4.90 per troy ounce.

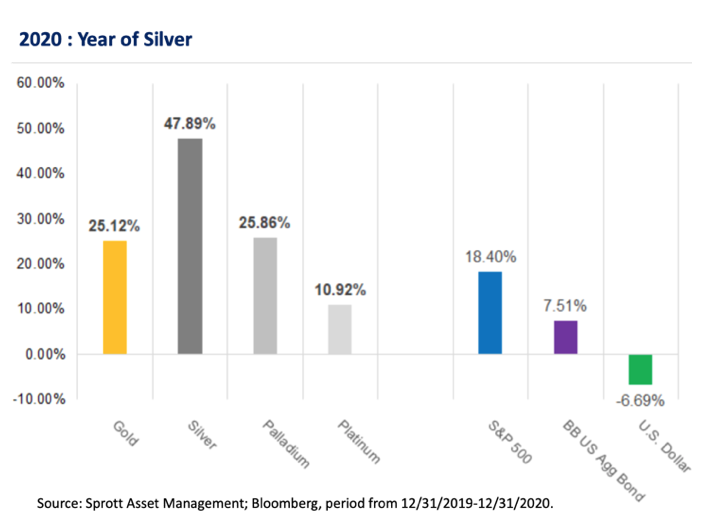

Silver: The Precious Metals Winner in 2020

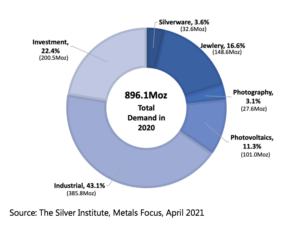

Renewed interest in investment in silver coupled with new industrial application propelled silver to a star performer status in 2020. The macroeconomic uncertainties, fuelled by continuing fiscal stimuli, ultra-low interest rates and worries over post-COVID recoveries provided an environment for increased interest in silver as a store of value and as an investment asset.

Demand for silver bars, coins and ETFs was surging. Global physical silver investment (silver coin and bar purchases) grew 8% to 200.5Moz, while the silver-backed traded products increased almost threefold to 331Moz. Simultaneously global push towards greener and more sustainable world opened up many new applications for silver, driving prices even higher. As a result, 2020 was a breakout year for silver, raising more than 47%.

Silver is widely expected to continue to benefit from the transition to the green energy which unravelled many new applications and growing need for silver.

Silver underpins the “Green Revolution”

It is becoming increasingly evident that availability of silver will play a critical part in global efforts to decarbonise and electrify the world. Typically, discussions around renewable power generation and battery storage would prompt concerns about availability of cobalt, nickel and lithium, but it is becoming increasingly evident that silver will play a particularly important role, in adoption of

1) Photovoltaic panels

2) Electric vehicles

3) 5G (Fifth generation technology) broadband cellular networks.

Silver – Powering Photovoltaic Panels

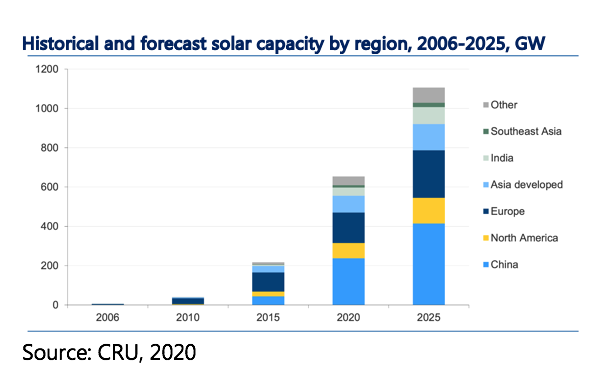

Solar, or photovoltaic (PV) panels already consume a growing portion of the silver market, which at 2020 accounted to 101 million ounces per year, or 10% of the overall consumption.

A PV solar power system captures sunlight that hits the solar cells, turning it in to electrons for energy to use instantaneously or to store it for later use. Silver is used in the form of pastes within the cells which ensure that the electrons move into storage or enable consumption, depending on the need. Advances in technology have resulted in using less silver per PV panel and continued innovations are likely to further reduce the amount of silver needed in each cell, which is referred to as “thrifting”. However, overall cost reduction of solar panels is leading to an increase in the number of solar panels in use, which is likely to offset the overall quantity of silver required in the photovoltaic industry.

Furthermore, technological innovations in the solar industry may reverse thrifting due to new types of panels requiring higher levels of silver loading. The continued growth of electricity demand coupled with rising commitment that this electricity comes from renewable sources, including solar power, are expected to see accelerated uptake of photovoltaic usage in the foreseeable future.

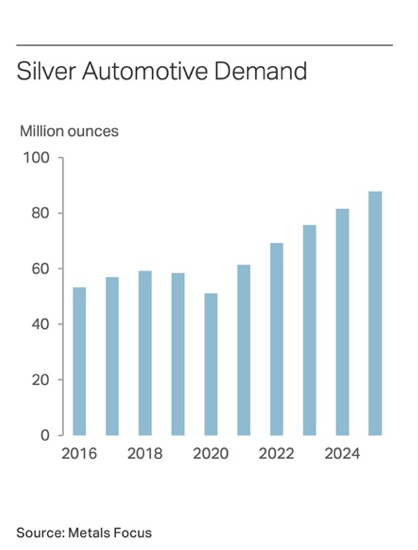

Silver – growing component of the future vehicles

Silver has played a role in the automotive sector going back many decades, primarily because of its thermal and electrical conductivity, which is higher than in any other metal. In the initial decades of automotive production, silver’s use was relatively limited, being primarily used as connectors for power linkage in batteries, generators and alternators. From around 1960 to the 1980s, as vehicle sophistication was evolving, so was the adoption of silver-bearing devices such as air-conditioning units. With increased implementation of electronic components and control units in each car, also rose the silver use as silver is found throughout vehicle’s electronic systems.

Presently, growing internal combustion engine (ICE) powertrain electrification has underpinned the increased use of silver globally in the automotive industry. Furthermore, the gradual transition to electric vehicles (EV), and much further ahead, autonomous driving, will each benefit silver automotive offtake. The increasing use of engine control units (ECU) in also of pivotal importance to automotive silver demand.

For ICE and hybrid powertrain control modules, silver membrane stiches are used in the engine ignition, while silver bearing contacts are used in various control systems to help the engine operate efficiently.

For ICE and hybrid powertrain control modules, silver membrane stiches are used in the engine ignition, while silver bearing contacts are used in various control systems to help the engine operate efficiently.

Growing demand for silver in the automotive industry is not only because of its direct use in EVs and hybrid cars but also due to silver’s wide use in charging stations, additional electric power generation and other supporting infrastructure. It is estimated that by 2029, there will be 10 million public and 50 million private charging points worldwide (Source: IDTechEx).

The Silver Institute estimates that the automotive sector demand for silver will raise to 88 million ounces by 2025 driven by this transition to electric and hybrid vehicles.

Silver – enabling 5G connected world

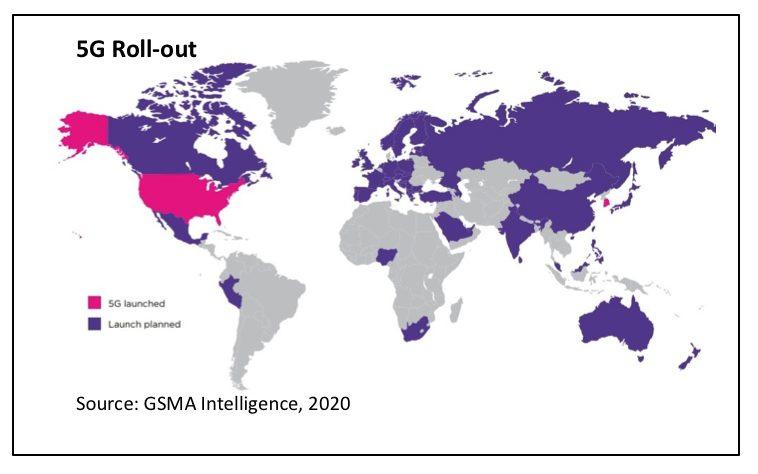

Built on the foundation of the fourth generation (4G), the next generation mobile network – the fifth generation (5G) is not just an incremental improvement over 4G — it is projected to be the next major evolution of mobile communication technology. 5G is expected not only to massively improve download speeds and reduce latency, but most importantly, it will facilitate significant technological progress in a whole range of sectors, such as the Internet of Things. (IoT) and autonomous driving. 5G will transform entire industries and enable resilient, high-speed, high-volume internet connectivity from practically anywhere and on any device or sensor.

The electronic components that enable 5G technology will rely strongly on silver to make the global 5G platform perform seamlessly. As electronics continue to get smaller, this will require denser packaging technologies. In a future 5G connected world, whether in chips, IoT devices, vehicles, smartphones or other

tools, silver will be a necessary component in almost all aspects of this technology, resulting in yet another end-use for silver in an already vast demand portfolio.

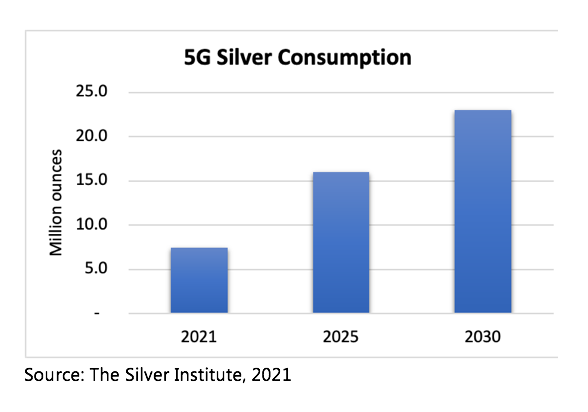

At present, the 5G deployment is still in its early days, and as such, demand for silver constitutes approximately 7.5 Moz or 0.75% of current annual supply. According to the Silver Institute, with the rollout of 5G in the coming years, silver demand is expected to grow current levels to approximately 16 Moz by 2025 and as much as 23 Moz by 2030, or approximately 2.3% of annual supply.

Many Uses of Silver

Jewellery and silverware

Throughout the history, the major use of silver besides coinage was in the manufacture of jewellery and other general-use items, such as silver cutlery, silver goblets and different dishes. Recently, changes in fashion trends as well as the growing demand for mid-priced jewellery have thrust silver again into the forefront of jewellery design. Tiffany’s silver jewellery and objet d’art still remain top objects of desire. Because of its beauty, lustre, and workability designers are increasingly presenting silver to fashion conscious consumers.

Silver comes in various purities. The purest silver is .999 fineness, which is 99.9% silver and is considered too soft for jewellery making. For this reason, jewellery designers add harder metals, like copper, to strengthen it. This produces what is known as “sterling silver.” Sterling silver is 92.5% silver and 7.5% copper. Sterling silver has been a standard for silver jewellery in many countries for centuries.

Medicine

Silver is widely used in medicine. Nowadays it is commonly incorporated into wound dressings and deployed as antibiotic coatings in medical devices. Silver nitrate and silver nanomaterials are used to treat external infections and as an antimicrobial element in surgical equipment, ointments, wound dressings, bandages, eye drops, dental alloys and more.

Silver is gaining importance in fighting the spreading of superbugs in hospitals. The use of silver in coating surfaces and medical equipment has been found to help reduce pathogen spread. Silver coated catheters and tubes are becoming very common in health care because the silver coating helps prevent infections from developing through their use. 3D silver surgical mesh helps support tissues and organs during surgery. Post-surgery, openings will be closed up with the use of silver needles and stitches.

Disease diagnostics is one of the latest developments to involve the use of biosensors made from silver nano wire. Weaving bio-sensing silver fibres in the clothes fabric, allows monitoring of physical information about the wearer, such as breathing and heart rates, stress levels etc., which then can be transmitted via Bluetooth to a selected device.

Electronics

Silver is very important in electronics for conductors and electrodes on account of its high electrical conductivity even when tarnished. Silver is an essential component of long-life batteries such as silver oxide batteries and silver zinc batteries. These batteries can last half as long as lithium-ion and other traditional batteries. Bulk silver and silver foils were used to make vacuum tubes, and continue to be used today in the manufacture of semiconductor devices, circuits and their components.

Chemical applications

Due to its low chemical reactivity, high thermal conductivity, and being easily workable, silver is useful in the manufacture of chemical equipment. Equipment made to withstand high temperatures is often silver-plated. Silver and its alloys (e.g. with gold) are used as wire or ring seals for oxygen compressors and vacuum equipment. Silver-containing brazing alloys are used for brazing metallic materials, mostly cobalt, nickel, and copper-based alloys, tool steels, and precious metals.

Photography

Historically, photography and film were amongst the earliest adopters of silver. Photographic film is essentially a sheet of transparent plastic coated on one side with silver halide. The photosensitivity of the silver allowed it to be essential in traditional photography. However, with the arrival of digital photography, the use of silver nitrate and sliver halides in photography has rapidly declined since digital photography does not need silver. Nowadays use of silver in photography accounts for only 3% of overall silver consumption.

Silver nanoparticles

Nanosilver particles, between 10 and 100 nanometres in size, are used in many applications. They are used in conductive inks for printed electronics and have much lower melting point than larger silver particles of micrometre size. They have many medicinal uses, in particular in antibacterial and antifungals in much the same way as larger silver particles. Additionally, silver nanoparticles are used both in pigments, as well as cosmetics. South Korean and Vietnamese companies are manufacturing infant products like nursing bottles, dummies, and baby wipes, using silver nano particles.

Other miscellaneous uses

Pure silver metal is used as a good colouring. Traditional Pakistani and Indian dishes sometimes include decorative silver foils known as vark, and in various other cultures, silver dragée are used to decorate cakes, cookies, and other dessert items. In order to prevent bacteria and other harmful microbes enduring on cutting boards, Japanese and South Korean cooks use cutting boards infused with silver particles. Silver is also used for its antibacterial properties in water sanitisation. Colloidal silver is used to disinfect closed swimming pools; while it has the advantage of not giving off the smell like hypochlorite treatments do, colloidal silver is not effective enough for more contaminated open swimming pools.

2020 – Silver Production Registers the Fourth Consecutive Annual Decline

As a metal, silver is extremely pliable, elastic, heat resistant, conductive, non-corrosive and non-toxic in low quantities and does not readily oxidise. The metal is found in the Earth’s crust in the pure, free elemental form (“native silver”), but more commonly is found combined with other metals, or in minerals that contain silver compounds, generally in the form of sulphides such as galena (lead sulphide) or cerussite (lead carbonite). Most silver is produced as a by-product of copper, gold, lead and zinc refining.

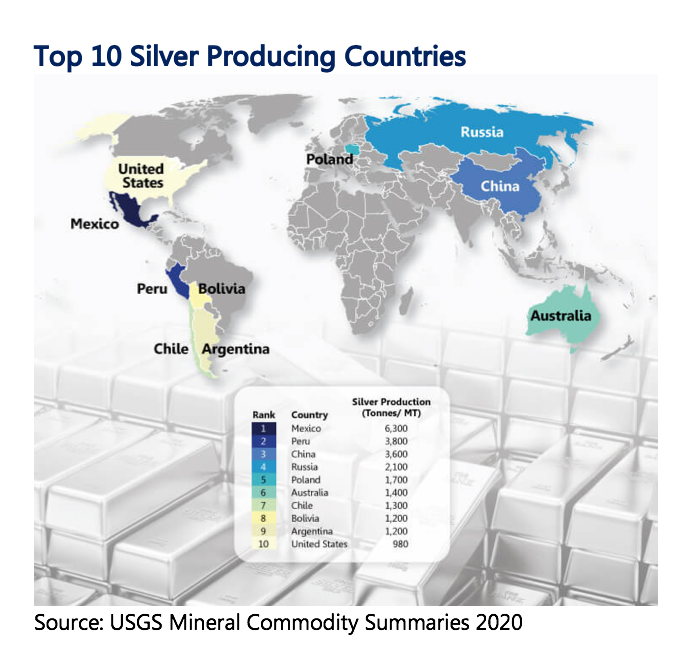

Peru and Mexico have been mining silver since 1546 and remain the major world’s producers.

Some of the biggest silver mines ever developed are in Latin America: Pensaquito, 27.8Moz (Mexico), Antamina, 16.4Moz (Peru), Saucito, 15.5Moz (Mexico), San Julian, 13.3Moz (Mexico), Fresnillo, 13.1Moz (Mexico), and Chuquicamata, 10.9Moz (Chile).

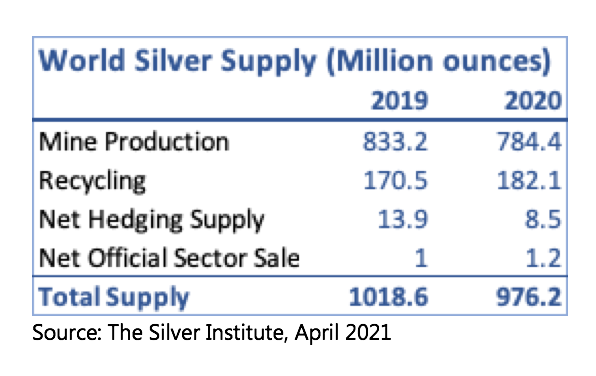

Silver supply primarily comes from mine production, with a smaller contribution from recycling (18.7% in 2020).

In 2020 , global silver mine production declined to 784.4Moz, which was the fourth consecutive annual decline and the most significant drop of the last decade. This fall was partly due to COVID-19 pandemic related mine closures, but also reflecting depletion and scarcity of the primary silver mines.

The apparent growing demand for silver as both investment and industrial metal, coupled with decreasing supply, is set to continue to provide an environment for silver prices to continue to raise in the foreseeable future.