OCIM Precious Metals taking a role in the sustainable development of Artisanal and Small-Scale Gold Mining

Artisanal and small-scale gold mining (ASGM) is an integral part of a global gold mining industry. As a sector, it accounts for approximately 20% of the global gold supply, making it an approximate US$35bn industry per year. Furthermore, it is a significant source of livelihood for millions worldwide, from individual gold miners and their families to more mechanised operators. The International Council on Mining and Metals (ICMM) estimates that as many as 100 million people rely on ASGM, either directly or indirectly and the sector is growing. By creating a demand for goods and services, the ASGM sector plays a key role in the generation of income in communities, where other opportunities can be scarce.

As a part of its ethos and business strategy, OCIM Precious Metals is looking for ways to participate in this segment of the mining industry and contribute to a social and economical transformation while remaining constant to its business model.

Setting the scene – ASGM sector covered in controversy

ASGM is a controversial sector, often stuck with a negative perception as a source of adverse social and environmental impacts, including child labour and the widespread use of mercury, a highly toxic metal. Historically it has also been associated with corruption, money laundering and other illicit activities. In some cases this was deserved, but in many it was not, however, this adverse reputation resulted in almost impregnable barriers to the access to formal finance.

The most fundamental barrier in the access to finance is the informal (and sometimes illegal) status of many ASGM operations. Investors are typically unable to enter into any finance agreements with operations that lack legal status. Sometimes ASGM operations manage to legalise their status, but fail to meet various due diligence requirements. Complying with environmental, social and governance (ESG) standards, as well as financial requirements often proves to be an insurmountable obstacle, as some ASGMs may not even know how to document their compliance. Lack of business experience/information is another difficulty. Many ASGMs are unfamiliar with the formal finance structures, their availability and implications. Size is a very common barrier to finance. Many ASGM operations are often too small, lack sufficient collateral and the transaction costs might be prohibitive.

In general this complete mismatch between a myriad of conditions required by formal finance, harsh realities of ASGM field operations and perceived impossibility of ensuring compliance with the requirements of the OECD Gold Due Diligence Guide, result in lack of adequate financial products that meet specific ASGM needs.

Thankfully times are changing for the ASGM sector

In recent decades, governments around the world, have recognised that ASGM can be a significant source of tax income and royalties as well employment in remote areas. With a strong support from the World Bank, development agencies and public donors a notable progress has been made in formalising and incentivising the ASGM sector. Latin America in general and Peru in particular have been leading the charge in transforming ASGM.

As a result of this intensified focus on the sector, it has been now widely accepted that in order for ASGM to serve as an economic catalyst, the sector requires adequate knowledge transfer and appropriate access to finance that will allow for the deployment of cleaner and more efficient technologies and sound environmental management.

With this increased interest from the International community, access to finance for ASGM has started to widen.

Access to Finance – can be as informal as miners themselves…

Historically, in the absence of formal finance, ASGMs would create relationships with informal financiers, so called “middlemen”. Although unfair and often “unscrupulous” arrangements, these informal financing provisions offer one advantage, which is, easy and quick access to money, often needed to survive and feed their families.

Microfinance has been tried with ASGM, with varied success. Finance providers would often focus on the financial strength of the borrower rather than knowledge and experience, which could result in acquiring inappropriate equipment and ultimately borrowers’ inability to service loans. To address this need for education and monitoring, some governments have offered to ASGMs various Government-backed Finance Schemes. Several countries have set aside dedicated mining funds, typically combining national development budgets with revenue generated from permit fees, royalties and export earnings. However, many of these schemes have proven unsuccessful as a result of a combination of the mismanagement of funds, untimely repayments and the absence of monitoring.

Given the mixed success of these government backed mining funds, great hope was put into Blended Finance, an emerging pool of money that combines governments’ and other donors’ funds with commercial finance structures in blended finance models. They have proven to be more successful financing programs as they offer greater monitoring of mining operations, as well as ASGMs’ compliance with ESG and other requirements. Public-private partnerships have also benefitted small-scale miners. One of the most successful examples is Sotrami S.A. in Peru, which with a US$1.3m loan from the Impact Finance Fund, grew from an artisanal operation of about 165 miners to a co-operative of over 1,000 members and revenue of close to US$50m.

Pure Equity Investment in ASGM is still rare and if it exists, it is connected with a conflict-free ASGM gold supply chain and the most advanced financial instruments like conflict-free Gold Backed Tokens.

Business Relationships between ASGM and medium and large-scale mining companies, offer another form of financial assistance and most importantly, knowledge transfer. More senior mining companies are understanding better the challenges within the industry, as typically they would operate in the same region with ASGM communities, which could all lead to some possible win-win arrangements, such as establishing small-scale processing centres that could serve as vehicles through which small-scale miners can access processing services for their mined ore.

Peru – at the forefront of change in ASM landscape

The mining industry is, and has always been very important to the national economy of Peru. It contributes considerably to the economy as a whole, accounting for about 10% to 15% of GDP, for 60% of the total export revenues and more than 50% of overall foreign investment.

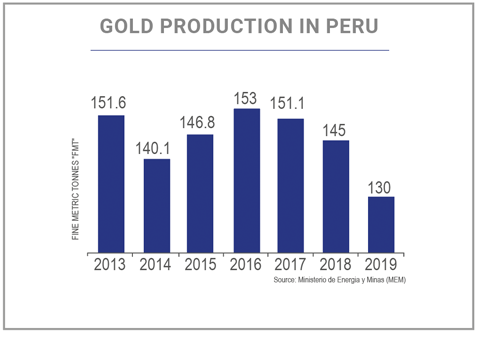

With its considerable and varied mineral endowment, Peru remains among the most important mining countries in the world. It hosts a large portion of the world’s reserves of silver, copper, zinc, molybdenum, lead and gold. The country is a top global producer of both gold and tin.

Peru’s history of mining dates well before the arrival of the Spanish, when Peruvian civilisation thrived and gold had been recovered from placer deposits in Andean rivers from as early as 1200BC. As such, Artisanal and Small Scale Gold Mining is an ancestral activity. In a succession of civilisations beginning with that of the Chavin, gold mining and goldsmith skills developed over 2,500 years and particularly prospered during the Chimu Empire in Northern Peru. Chimu gold artisans were particularly advanced, and developed alloying, welding and gold plating. The Inca as well as other peoples of the Andean region, referred to gold as the «sweat of the sun» – the most sacred of all deities.

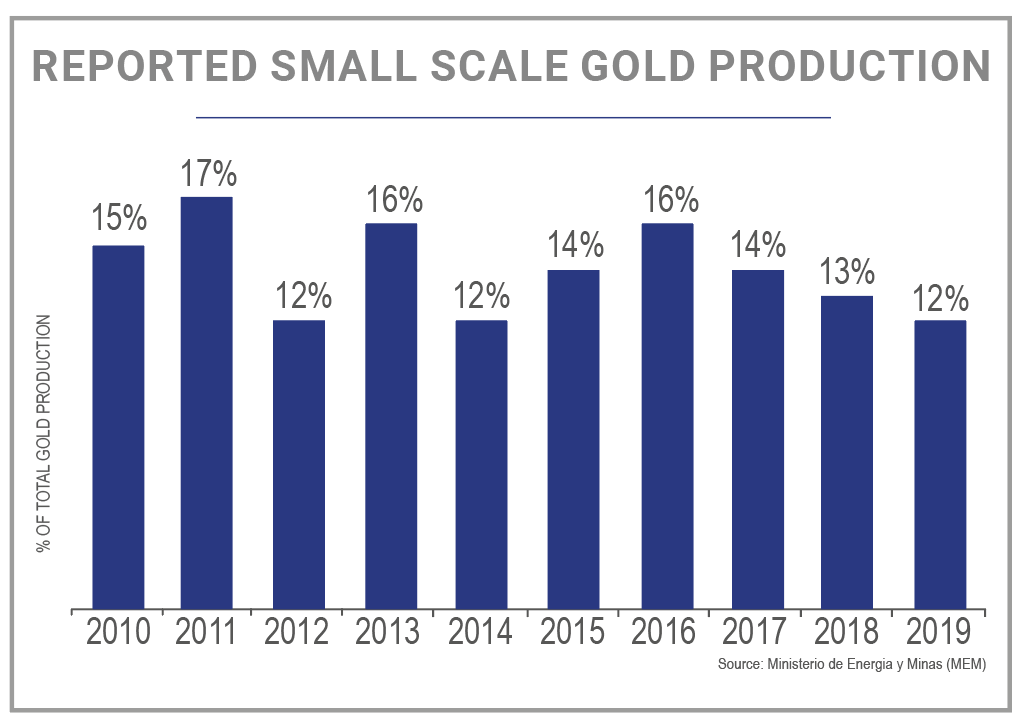

With such a long history and tradition of artisanal mining, it is not a surprise that today’s ASGM sector in Peru is among the best developed in the world. Ever since the early 1980’s, ASGM experienced a great surge in operations, whilst the government embarked on an ambitious legislation and formalisation process of the ASGM sector. It was and still is, a process with varying success, but admittedly Peru today has 88,000 registered small-scale miners who operate within a legal framework and who need to process their ore at legal, independent ore processing facilities. It is estimated that at least 15,000tpd of ore is being produced by ASGM, with average head grades of 0.5oz/t processed. Over the last two decades, Peru has experienced a particularly rapid expansion in the ASGM sector, being upwards of 80% growth.

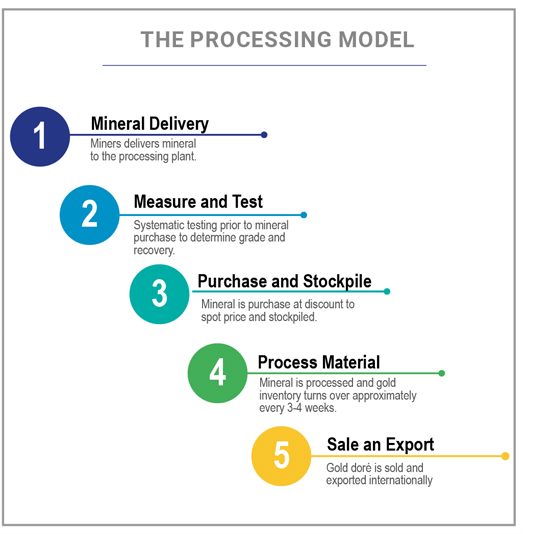

OCIM’s Solution – the Processing Model

Seeking to contribute to a transformation of the ASGM sector and its access to formal finance, OCIM Precious Metals’ solution is to offer funding to the gold toll milling operations, in what it calls the Processing Model.

Toll milling, also known, as contract processing or tolling is quite simply just an arrangement where a different party than a producer processes raw materials. Toll milling has likely existed as long as there has been mining. The concept is straightforward: someone buys ore from a miner, processes it and aims to make a profit by selling the finished product. It can be done with nearly any metal, but gold is the most common. A typical profit that toll mills aim for (and not necessarily always achieve) is 15-20%.

Whether a toll milling plant is run by an exploration company wishing to generate cash-flow to fund its own exploration activities without continuous dilution of shareholders’ value, or as a stand-alone business it is an important part of the ASGM landscape.

Relatively inexpensive to build, toll milling operations come with its own set of challenges. While there are typical trials associated with operating any processing plant, toll milling has two unique challenges: Supply and Metallurgy and these two are closely related.

Supply

Success of a toll-milling operation is hugely dependent on the continuous supply of raw material, which in turn depends on its relationship with small-scale miners and in particular transparency, pricing and incentives offered to small-scale miners.

Transparency

Miners will consistently bring ore to millers they trust and where they know, that they are getting paid a fair price for their ore, every time. In the industry, often running crippled by mistrust, allowing miners to observe the measuring and assessment process, as well as test their ore independently if they wish, is key to the success of those operations.

Pricing

In order to maintain lasting relationships and a steady supply of ore, toll processing companies utilise pricing models that provide them with the target profits but also offer ASGMs good value. ASGMs are offered a fair, consistent price as well as fast and efficient payment. In order to do this, toll-milling companies must have sufficient working capital to pay up-front, thereby limiting the wait times for miners.

Added Value

In addition to simple cash payments for their ore, toll-milling companies often offer other incentives in order to add value to their ASGM partners. These incentives could be anything from offering micro-loans to purchase equipment, helping them complete formalisation process or assisting them with environmental best practices. Some toll millers are seeking to partner with international organisations, NGOs or governments themselves to help their suppliers in achieving better technical and environmental practices and accordingly establish them as a preferred partner.

Location

Although small-scale miners are prepared to travel and sometimes they do cross over 1,000km to reach the toll mill of their choice, strategic location in the vicinity of ASGM operations is of paramount importance.

Metallurgy

In addition to securing a continuous supply of raw material, another significant challenge facing toll millers is metallurgy and recovery. Unlike traditional miners who know their deposit, have control over the feed and can plan production ahead, toll millers rely on hundreds of suppliers producing material at different rates, at a variety of grades and from a host of deposits each producing material with unique metallurgical properties. The success of a toll milling operation is greatly dependent on its ability to produce an optimized feed for a generic mill, which in turn is dependent on its ability to accurately establish the grade of ore upon delivery and subsequently achieve their target recovery. Most toll milling operations aim for 90-95% recovery, which in reality can be only achieved after years of relationship-building with suppliers and experimenting with mixing ores from different origins.

OCIM Precious Metals completes US$2.5m funding of Inca One Gold Corp. (TSX-V: IO)

Recently OCIM Precious Metals SA provided Inca One Gold Corp. with a US$2.5m short-term gold loan to fund its working capital and ore purchasing, with a view that this would become a larger, revolving, long-term facility.

Currently Inca One operates two, fully permitted, gold mineral processing facilities in Peru. The Company produced nearly 25,000oz of gold in 2019 and has generated over US$100m in revenue over the last five years.

Inca One has a combined 450tpd permitted operating capacity at its two fully integrated plants, Chala One (100tpd) and Kori One (350tpd).

Koricancha, or so called Kori One Plant

Kori One is a fully operational, industrial gold ore processing facility, featuring a carbon-in-leach gold circuit, with in-house, metallurgical and chemical labs, desorption and smelting facilities.

It is strategically situated in the Arequipa region, Southern Peru and just 10 minutes from the Pan American Highway, within the Nazca-Ocona gold belt, in a highly concentrated, high-grade, small-scale mining district. Located in a desertic environment, with 42 acres of land thereby providing ample room for plant expansion and tailings disposal. Kori One built and permitted for 350tpd and has been operating at an average of approximately 135tpd since January 2018, when it was purchased from Equinox Gold.

When fully ramped up, the Kori-One ore processing facility has the potential to produce 50,000 to 75,000 ounces of gold annually.

Chala One Plant

Located in Chala, 47km away from Koricancha, Chala One was acquired in 2013. It commenced commercial production on February 1, 2015 after successfully upgrading the processing capacity to 100 tpd.

In 2017, after completing its environmental and operating studies, Chala One became a fully government permitted processing facility. With the successful completion of the permitting process, Inca One became the first publicly listed gold processing company to complete its permitting under Peru’s formalization legislation. Today, the Chala One Plant constitutes a full-service milling facility, with weighing, sampling and metallurgical test facilities on site, along with crushing, grinding and carbon-leaching circuits, full material handling, desorption, smelting and tailings disposal facilities. Inca One Gold Corp. has entered into multi-delivery Letters of Agreement (LOA) with several legal small-scale miners. The Company’s target is to have 50 percent of its mill feed under LOAs, with the remaining 50 percent of its mill feed coming from spot purchases in the market. With OCIM’s revolving facility in place, Inca One’s target is to ramp up production to 300tpd within 12 months, and to full 450tpd within 24 months. At a full capacity Inca One’s facilities can produce 75,000oz of gold per annum and generate close to US$140m in revenue per year, assuming a US$1,850/oz gold price.

In countries like Peru, with a vast and reasonably advanced small-scale mining activity, there is, clearly a need for independent and centralised gold processing mills. By funding companies like Inca One, OCIM Precious Metals is aiming to make its contribution to the positive transformation of Artisanal and Small-scale Gold Mining sector, while remaining within its business model and by backing up experienced and dedicated management teams who look to improve working conditions and lives of ASG miners.