2020 created a perfect storm for platinum and PGMs: what does the future hold?

Throughout 2020, the global COVID-19 pandemic, supply interruptions, tightening emissions legislation, a greater commitment to the hydrogen economy, faster than expected recovery in car sales and a continuous increase in investment demand created a perfect storm for Platinum and Platinum Group Metals (PGM). From the COVID-19 induced lows in March 2020, the platinum price rose by more than 90% , reaching its 6-1/2-year peak of US$1,260 per ounce by early 2021. While palladium remained somewhat shy of this spectacular performance, rhodium did not disappoint, starting the year 2020 at less than US$6,000 per ounce it skyrocketed to US$27,000 an ounce by March 2021. This paper investigates the dynamics of overall PGM market, current exuberant pricing and aims to provide an insight into the future of platinum and the PGM sector.

The Platinum Group Metals comprise six noble, precious metallic elements clustered together in the Periodic Table as well as in nature: ruthenium, rhodium, palladium, osmium, iridium and platinum. They are all transition metals, have similar physical and chemical properties and tend to occur together in the same geological settings. The PGMs are well known for their catalytic properties and as such, are most used as vehicle exhaust catalysts. Platinum, palladium and rhodium are installed in the exhaust system of vehicles to reduce harmful emissions, for instance carbon monoxide (CO), by converting them into less harmful gases. Commercially, platinum, palladium and rhodium remain the most important and most critical of this group of elements.

—————————————————–

Platinum is one of the rarest elements in Earth’s crust (only the 72nd most common, out of 92 natural elements) and is the most important of the six PGMs. Its name is derived from the Spanish term platino, meaning “little silver”. Platinum is heavier than gold (21.5g/cm3 vs. 19.3 g/cm3) and more noble (less reactive) and in refined metal terms platinum is thirty times rarer than gold.

—————————————————–

2020 exposed vulnerabilities of the platinum market

- Due to processing outages and pandemic-related mines disruption in South Africa – primary platinum supplies declined by 20%.

- Auto recycling contracted sharply on weak diesel car replacements in Europe and processing capacity constraints.

- Autocatalyst consumption dropped by 22%, with steep falls in European diesel car production.

- The industrial segment weathered 2020 better, especially in China, where petrochemical and glass expansions continued throughout the year.

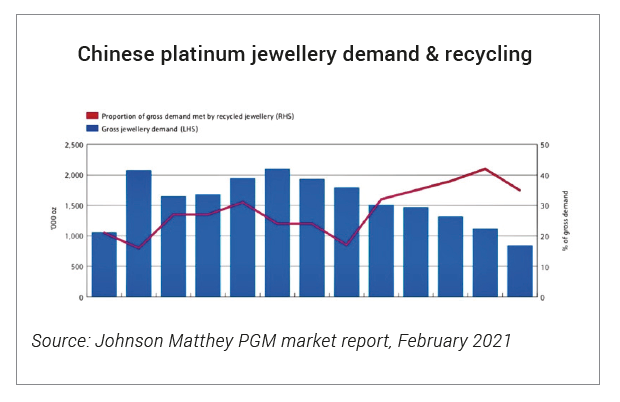

- Plummeting jewellery demand in particular in China, was offset by strong investment demand, ETFs and bars.

- The platinum market remained in deficit in 2020, with lower supplies and strong investment demand, pushing prices higher.

Platinum gained its importance as an industrial metal due to its catalytic properties, i.e. its ability to speed up a chemical reaction without itself being changed in the process. Because of its scarcity in the Earth’s crust, only a few hundred tonnes are produced annually (c. 6-8million ounces), and given its important uses, it is highly valuable as well as increasingly becoming an investment metal and a store of value.

Platinum Supply: Highly concentrated resources, wrapped in political and social issues make platinum supply highly vulnerable

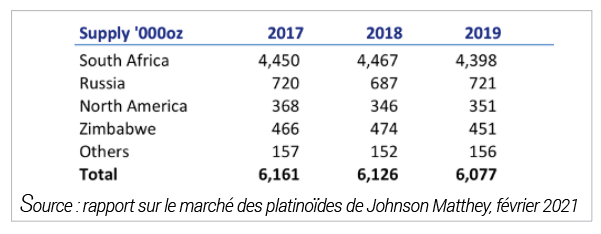

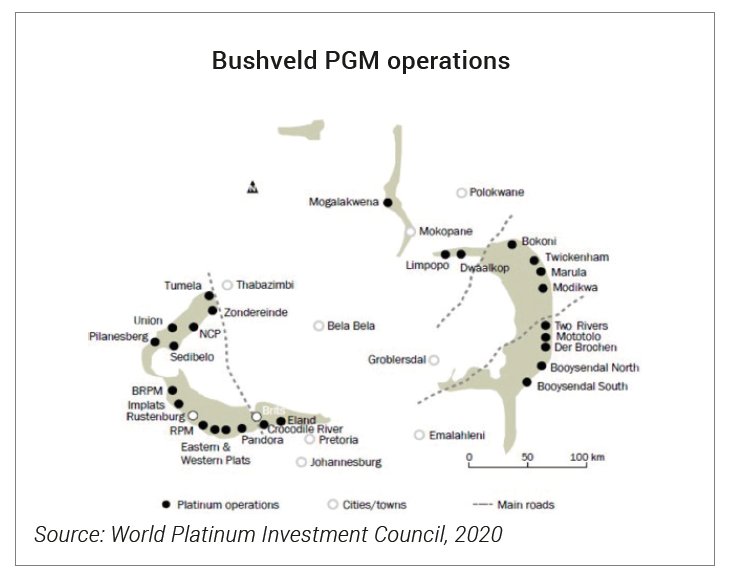

Over 80% of the world’s known economically viable platinum reserves are mined in a relatively small region – the Bushveld Igneous Complex (Bushveld) located in the northern part of South Africa. The balance comes from Zimbabwe (Great Dyke), Russia and North America. Southern Africa is the only primary source of platinum, while platinum from Russia and North America comes as a by-product of other mining operations, primarily nickel.

The two types of the Bushveld PGM ore bodies in the western and eastern parts (“limbs”) are the Merensky and Upper Group2 (UG2), traditionally mined from deep, labour intensive, underground mining operations (700m-1,700m depth).

In the northern part of the Bushveld, the PGM ore, so called Platreef, is close enough to the surface for some mining to be open pit. Nevertheless, the majority of Bushveld platinum comes from underground hard-rock, narrow-seam mining with high fixed costs and high labour costs. Years of under-investment have made these operations difficult and prone to operational and social issues. Over the last 35 years, South Africa hit international headlines many times due to platinum mining related strikes, including some with serious consequences such as the ‘Marikana killings’ in 2012.

The influence of the South African supplies on platinum and PGMs pricing is not only reflected through location and constraints of its mines, but also the exchange rates between the South African Rand (ZAR) and the US$ dollar. In PGM mining, 80-90% of operating costs are in local currency. Labour typically accounts for 60% of operating costs and electricity around 15% and both are intricately linked to the local economy. Hence, there is a strong perception that the ZAR should have a strong effect on the platinum price, i.e. weakening ZAR should lead to the falling US$ platinum price and vice versa.

Future platinum supply remains contingent on South Africa resolving many of its issues

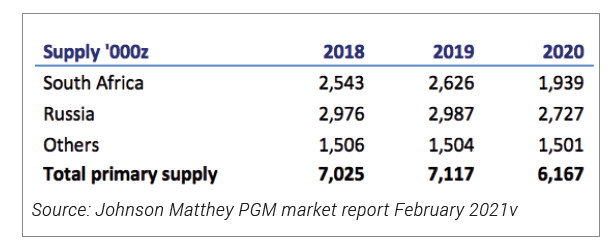

Global platinum supplies fell by 20% in 2020, caused by many operational and non-operational issues in South Africa.

South Africa was hit particularly hard by COVID-19, particularly with the rise of a local variant virus that proved to be more contagious than the initial coronavirus and resistant to at least one of the newly approved vaccines. On-going lockdowns and labour shortages issues caused significant mining interruptions.

During 2020, South African platinum supply was impacted above and beyond COVID-19. Refined platinum production at Anglo American Platinum, one of the world’s largest PGMs processing facilities, experienced outages at both the Phase A and Phase B units at its Anglo Converter Plant (ACP), causing a fall in refined platinum production by nearly 70% over the previous year. The impact of those outages was somewhat offset by the fact that COVID-19 related mine closures overlapped with the ACP shutdown, and this helped limit the build-up of inventory. Although both units were eventually recommissioned and came back on-stream, Anglo American still ended 2020 with excess pipeline inventory containing over 1m ounces of PGMs. Processing of this backlog will contribute to overall global platinum supplies in 2021 and 2022.

After making an allowance for all inventory changes, the overall drop in platinum supply in 2020 coming from South Africa was closer to 27%, with supplies reaching only 3.2m ounces.

Zimbabwe was equally affected by the pandemic. However given that the mining operations are more mechanised, it was possible to operate during the country’s lockdown period and Zimbabwe’s contribution to platinum supplies rose slightly to c. 490,000oz in 2020.

Elsewhere, COVID-19 related disruptions to mine production were less prominent. In Russia, although Norilsk Nickel reporetd no pandemic related interruptions at its operations, platinum output still declined moderately in 2020, reflecting the depletion of PGM-rich surface materials that have contributed materially to ouput during recent years.

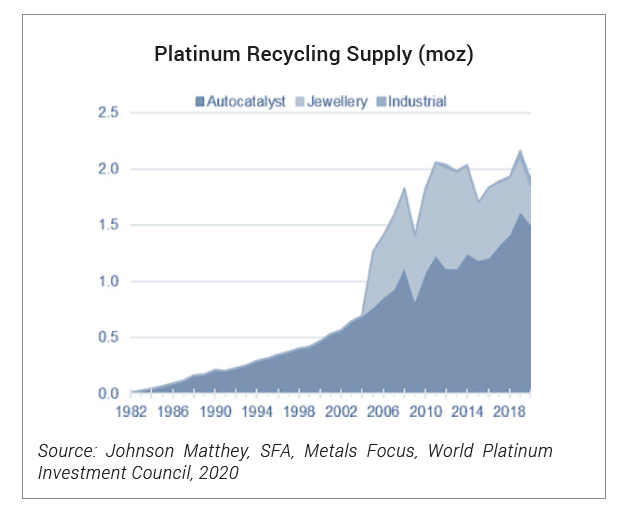

Secondary Supplies – Platinum recycling will continue to play a major role

Platinum is highly recycable and this source of supply has become more meaningful since 2000. The main source of recycled platinum comes from recycled emissions control autocatalysts when vehicles reach the end of their lives. Almost all catalysts are removed and recycled. Current platinum recycling is a mature business with largely fixed margins, directly related to the spot price of platinum. This is because the price paid for scrap catalysts is based on metal content at market prices.

Platinum is highly recycable and this source of supply has become more meaningful since 2000. The main source of recycled platinum comes from recycled emissions control autocatalysts when vehicles reach the end of their lives. Almost all catalysts are removed and recycled. Current platinum recycling is a mature business with largely fixed margins, directly related to the spot price of platinum. This is because the price paid for scrap catalysts is based on metal content at market prices.

Platinum recycling, like primary supplies, experienced significant COVID-19 related disruption. Platinum recoveries fell by around 21%, reflecting a steep drop in the amount of autocatalyst and jewellery scrap being collected. Some scrap yards were closed and cross-border collection of scrap was particuarly problematic in Europe, especually during the first pandemic wave. Nevertheless, in 2020, recycled material from autocatalysts, jewellery and electronic sectors still ammounted to c. 1.7m ounces and accounted to c. 25% of total global platinum supply.

Platinum Demand

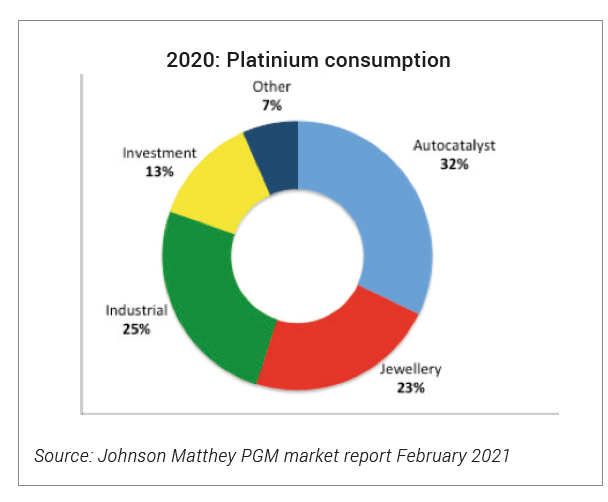

Due to its physical and catalytic properties, platinum has a wide range of uses and applications in many sectors, such as automotive, jewellery and industrial as well as a growing use in physical and physically backed investments.

By far, the largest use of platinum is in the automotive industry, specifically in catalytic converters, shortly followed by the industrial segment, like glassmaking and chemical production and jewellery. Financial investments, such as bars, coins, and ETFs have been on the rise in the recent years.

Global auto sales contracted by about 30% during the first half of 2020 but recovered somewhat in the second half. The COVID-19 pandemic intensified pre-existing weakness in the key European diesel car market, while heavy-duty truck production was significantly reduced in all major markets except China. As a result, in 2020 platinum demand contracted by 22% to 2.2m ounces, the lowest level since the Global Financial Crisis. The recovery momentum is expected to continue into 2021, with sales growth of about 9% projected for the year.

The second half of 2020 saw a resurgence in industrial manufacturing, first in China, and then across other regions. Jewellery purchases in 2020 were particularly hit and that segment reflected a well below usual platinum consumption. However increased platinum investment demand throughout 2020 has mostly off-set any losses encountered within the jewellery segment.

Automotive Demand: reducing emissions remains the key driver

Platinum is an excellent catalyst and is instrumental in the reduction of the three main emissions from internal combustion engines: unburned hydrocarbons (HC); carbon monoxide (CO) and oxides of nitrogen (NOx). Platinum and PGMs play a critical role in the catalytic converters used in internal combustion engines (ICE) and within this ICE segment of the auto industry, diesel engines drive more demand for platinum. A diesel engine typically requires 5 to 10 grams of PGMs, with the majority being platinum. A gasoline engine uses 2 to 7 grams of PGMs, relying more on palladium.

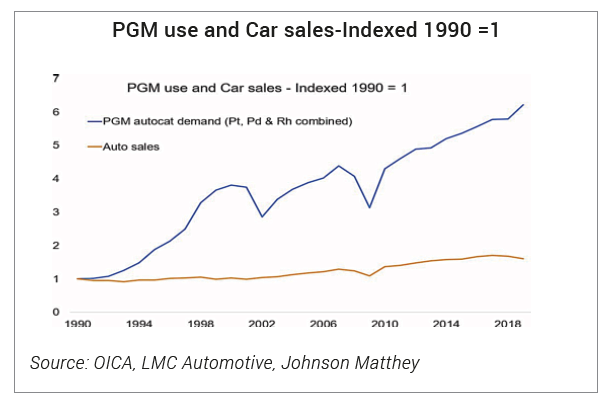

Historically, however the tightening of emissions legislation has driven platinum and PGM automotive demand growth, more than actual changes in volumes of auto sales. For instance, between 1990 and 2019 annual car sales rose from c. 54m to some 92m, whilst PGM use in autocatalysts rose from 2.2m ounces per annum to 13.8m ounces per annum.

Historically, however the tightening of emissions legislation has driven platinum and PGM automotive demand growth, more than actual changes in volumes of auto sales. For instance, between 1990 and 2019 annual car sales rose from c. 54m to some 92m, whilst PGM use in autocatalysts rose from 2.2m ounces per annum to 13.8m ounces per annum.

New regulations, such as Euro 6d, China 6 and India’s Bharat VI, to name the most important ones, have all started to have impact on platinum demand. The Euro 6d legislation, due to come into place by September 2022, implies that cars will need to meet limits on NOx emissions for on-the-road driving tests, rather than in tests in the laboratory. The China 6 standards, which started to be enforced in major cities across China from mid-2019, are even more stringent that the EU or US regulations. PGM catalysts became mandatory on all trucks sold in India from April 2020 following the introduction of the Bharat VI (BSVI) legislation.

Europe, by far the largest regional user of platinum in autocatalysis, was particularly hit hard in 2020 and demand dropped to a twenty-year low of below 1m ounces. COVID-19 lockdowns, which started in the second week of March, prompted a collapse in new car sales and temporary shutdowns at most major European car plants, resulting in European car production contracting by nearly 40% in the first half of 2020, versus the same period of 2019. From mid-year, the sector began to recover gradually, and it is estimated that European light vehicle production narrowed total 2020 loss to 20%.

Globally, during 2020, the brightest spot for platinum use in automotive applications was in the heavy goods vehicles (HGV) sector in India and China. PGM catalysts became mandatory on all trucks sold in India from April 2020, following the introduction of the Bharat VI (BSVI) emissions legislation, but the impact was reduced by an approximate 50% drop in in Indian heavy vehicle output.

China also saw a modest increase in platinum use by the heavy duty sector, as a small but increasing number of heavy duty trucks were equipped with platinum-containing catalyst systems capable of meeting the China VI legislation limits. From July 2021, these stricter standards will be enforced nationwide on all heavy vehicles.

Platinum use in diesel autocatalysts to replace palladium could grow by tens of thousands of ounces in the short to medium term.

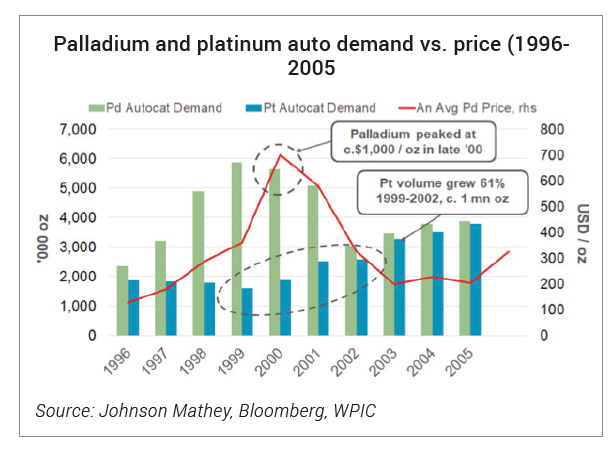

In 1974, the US was the first country, to introduce the emissions standard, which required the use of autocatalysts. This led to the use of both platinum and palladium in internal combustion engine vehicle emissions control. By the late 1990s, demand for palladium started to consistently exceed available supply.

Typically, this annual shortfall was supplied by Russian state stocks. In 2000, an administrative failure in Russia coincided with a processing failure in South Africa, which pushed palladium prices from around $200/oz to over $1,000/oz within a few months. This price spike forced auto manufacturers to look into substitution of palladium by platinum. As a result, gross palladium usage in autocatalysts was reduced by 48% between 1992 and 2002. Palladium prices quickly fell in line with reduced demand, to US$260/oz by January 2003, whilst platinum autocatalyst usage increased by 60% over this same period of time.

Typically, this annual shortfall was supplied by Russian state stocks. In 2000, an administrative failure in Russia coincided with a processing failure in South Africa, which pushed palladium prices from around $200/oz to over $1,000/oz within a few months. This price spike forced auto manufacturers to look into substitution of palladium by platinum. As a result, gross palladium usage in autocatalysts was reduced by 48% between 1992 and 2002. Palladium prices quickly fell in line with reduced demand, to US$260/oz by January 2003, whilst platinum autocatalyst usage increased by 60% over this same period of time.

However, until the early 2000s, twice as much palladium versus platinum by mass was required to achieve similar levels of emissions reduction in gasoline engines. Technological advances, principally the improved stability of PGM molecules in the coating on catalysts and the significant reduction in sulphur content of gasoline, reduced this substitution ratio to the point where similar amounts of platinum or palladium could achieve the same level of emissions control. This almost 1:1 substitution ratio suggests that platinum and palladium can be viewed as almost perfect substitutes.

At the current palladium premium pricing to platinum, and with a 1:1 substitution ratio between two metals, there is a very strong economic argument for auto producers to substitute more platinum on future models. Wider adoption of this practice is expected to be a major driver of future platinum demand.

At the current palladium premium pricing to platinum, and with a 1:1 substitution ratio between two metals, there is a very strong economic argument for auto producers to substitute more platinum on future models. Wider adoption of this practice is expected to be a major driver of future platinum demand.

Industrial demand

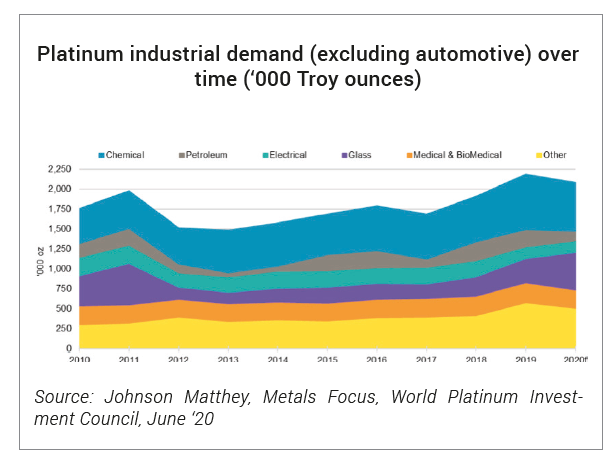

Given its unique properties, platinum has a broad variety of applications in the industrial sector (excluding automotive uses), typically grouped in five sectors: (1) Chemical, (2) Electrical; (3) Glass; (4) Medical and Biomedical; and (5) Petroleum.

It is important to note that, unlike for other usages, most industrial demand is represented on a net basis, i.e. the gross demand less the supply from recycled material.

Chemical – Platinum has been used in the production of nitric acid and nitrogen fertilisers for over a hundred years. A crucial step in nitric acid production is the oxidation of ammonia gas that requires platinum-rhodium gauze.

Electrical – Platinum is a component used in hard disk drives. It is a cobalt-chromium and platinum alloy, and acts as the storage layer in a hard disk drive.

Glass – glass is made from melting its raw materials at temperatures up to 1,700°C. LCD glass (used in watches, laptops) is one of the most intensive uses of platinum within glass, given its requirements for thin, high quality glass with zero defects.

Medical and Biomedical – In some chemical forms, platinum can inhibit the production of living cells. The discovery of this property has led to the development of platinum-based drugs to treat a wide range of cancers. These platinum-based antineoplastic drugs are used to treat almost 50% of cancer types.

Petroleum – In oil refining, platinum is used in reforming and isomerisation, which provides the higher-octane components needed for the production of gasoline fuel. The platinum is coated onto an alumina substrate in the form of small beads. Over time, technical developments have led to a reduction in the platinum required per unit; but this has been offset by the rise in demand for gasoline products; leaving the annual demand for platinum from petroleum sector fairly stable.

The impact of the COVID-19 pandemic has been extremely variable between different industrial applications and between regions. In China, 2020 was the final year of the Thirteenth Five-Year Plan, whose aim was to increase self-sufficiency in the petroleum refining and chemicals industries. As a result, demand from China was resilient, with new plant constructions proceeding and some advance purchasing of platinum, making the overall consumption of platinum in the petrochemical and petroleum refining relatively robust.

The impact of the COVID-19 pandemic has been extremely variable between different industrial applications and between regions. In China, 2020 was the final year of the Thirteenth Five-Year Plan, whose aim was to increase self-sufficiency in the petroleum refining and chemicals industries. As a result, demand from China was resilient, with new plant constructions proceeding and some advance purchasing of platinum, making the overall consumption of platinum in the petrochemical and petroleum refining relatively robust.

In contrast, demand from the European and North American petroleum and chemicals sectors declined in 2020. In the Rest of World, a decline in petrochemical plant construction caused a steep drop in platinum purchasing. However, this was related more to the investment cycle than to the pandemic.

In 2020, the glass industry saw many planned capacity extensions by Chinese fibreglass companies which also included some pre-buying of platinum for the future projects. These new plants are primarily intended to produce glass fibre for the domestic market.

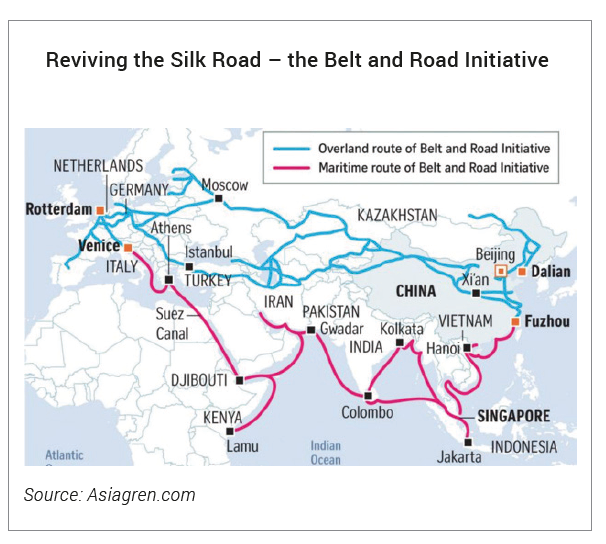

In particular, there has been strong investment in the wind sector, which uses glass fibre-reinforced materials in blades for wind turbines, as a part of the Belt and Road initiative to create a wind grid across Asia. Consumption of fibreglass in 5G telecommunications infrastructure also remains buoyant.

In particular, there has been strong investment in the wind sector, which uses glass fibre-reinforced materials in blades for wind turbines, as a part of the Belt and Road initiative to create a wind grid across Asia. Consumption of fibreglass in 5G telecommunications infrastructure also remains buoyant.

Elsewhere in the glass sector, the development of supply chains for COVID-19 vaccines has prompted an increased demand in platinum-containing equipment to produce speciality glass vials. However, the manufacturing of LCDs was greatly reduced, which resulted in an overall demand for platinum from the glass sector to decrease by 14%.

While many industrial sectors were adversely affected by the pandemic, some sectors conversely experienced increased demand for their products as a result of the pandemic. This was particularly true for companies supplying personal protective equipment (PPE) where platinum catalysts are employed in the production of medical-grade silicones, all utilised in nonwoven fabrics for PPE items including masks and biohazard suits.

Among other PGM applications, sectors closely linked to transport were the most severely affected by the COVID-19 pandemic. The use of platinum in aero engine turbine blades fell by nearly 50%, as Airbus and Boeing slashed aircraft production by around 40%.

In 2021 industrial demand for platinum expected to remain strong

With most industrial applications staging a strong recovery from COVID-related disruption, industrial demand for platinum is expected to be robust. Continuing investment in large integrated petrochemical complexes is expected to continue, stimulating purchases of platinum catalysts for new paraxylene capacity. The glass industry is equally expected to remain strong in 2021. Chinese demand for glass fibre has rebounded strongly following pandemic-related disruption in early 2020, and has been supported by rising requirements for glass-fibre-reinforced material in the wind power, telecommunications and construction sectors.

Investment demand

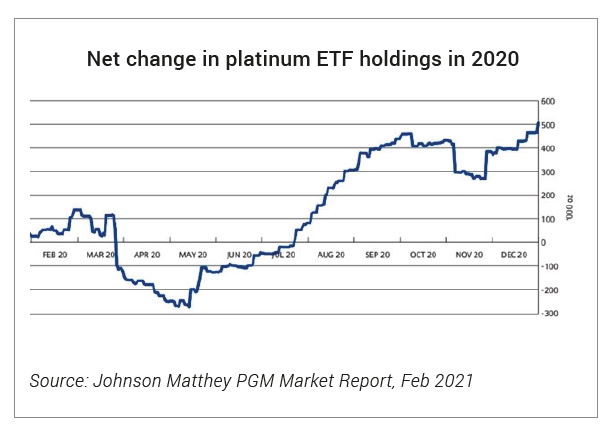

Growing investment demand has been a key driver behind platinum’s move into deficit over the past two years.

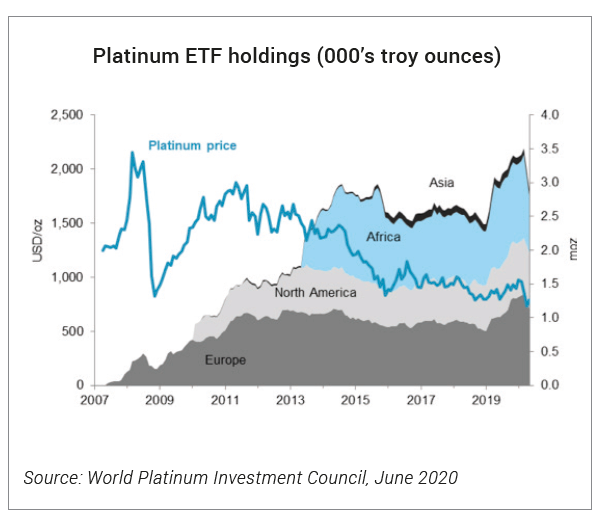

Platinum ETFs were created in 2007, and generally the volume of platinum invested has increased ever since, despite a broadly downward trending platinum price.

In the third quarter of 2020, global ETF holdings experienced significant buying. Between July and September, total ETF holdings rose by nearly half a million ounces to a record 3.8m ounces. Some of this was most likely ‘safe haven’ buying spilling over from gold, but buying was also encouraged by the improving sentiment towards platinum’s demand in gasoline autocatalysts and fuel cells.

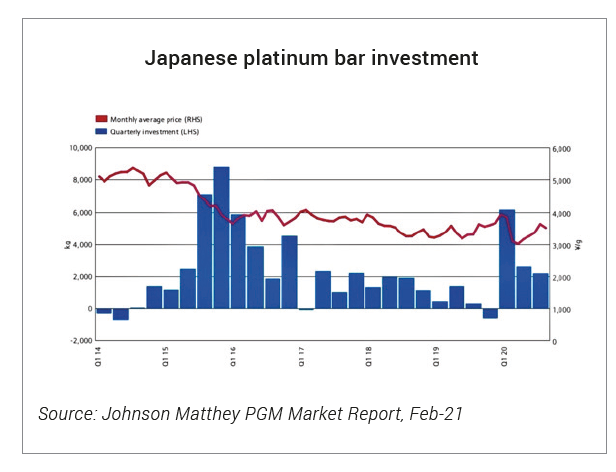

Platinum physical investments, such as bars and coins, are particularly popular in Japan with both retail and institutional investors. Purchases of physical investment bars set an all-time record for a single month in March 2020, as the daily retail platinum price dropped below the key ¥3,000 level, briefly touching a seventeen-year low of just over ¥2,500 per gram.

Platinum physical investments, such as bars and coins, are particularly popular in Japan with both retail and institutional investors. Purchases of physical investment bars set an all-time record for a single month in March 2020, as the daily retail platinum price dropped below the key ¥3,000 level, briefly touching a seventeen-year low of just over ¥2,500 per gram.

Furthermore, platinum’s discount to gold widened considerably during 2020,

nearly doubling between January and August to a peak differential of ¥4,000 per gram, reinforcing a buying opportunity. According to Johnson Matthey, Japanese investment demand totalled 340,000oz in 2020, exceeding its four-year high.

Jewellery demand

Use of platinum in jewellery is relatively recent phenomen, compared to gold, which has been used for centuries. Recognising a gap in the market, the Platinum Guild International (PGI) was set up in the mid 1970s’, with a purpose to develop the jewellery market for platinum. PGI’s market development resulted in annual platinum jewellery growing from almost zero in 1975 to 2.1m ounces in 2019. The PGI is particularly focused on emerging economies such as China and India, along with seeking to maintain and increase the share of platinum used in the jewellery in developed markets such a North America and Japan.

China and Japan maintain their strong preference towards platinum jewellery

In China, platinum has become very popular among Gen-Z and Millennial groups aged 18-45, with both being regarded as the future driver of jewellery consumption. Younger Chinese consumers prefer platinum in jewellery not only to signify relationship milestones such as engagements, weddings and various anniversaries, but also in a wide range of non-bridal types of jewellery, like fashion rings, necklaces, earrings and chains.

Platinum is also preferred by the Japanese, regardless of the jewellery type, particularly those aged between 46 and 55, followed by younger generation aged 18 to 30.

Demand for platinum jewellery in China was particularly weak during the first half of 2020, due to extended store closures and the consumer’s reluctance to spend on luxury goods. However, platinum jewellery fabrication picked up strongly in the third quarter, as record gold prices encouraged Chinese retailers to devote more counter space to platinum instead of karat gold. This was partly as a means of reducing costs in holding stocks, but also as a response to very weak consumer demand for karat gold jewellery.

Elsewhere, demand trends in 2020 were adversely affected by changes in consumer spending and behaviour due to economic uncertainties brought by COVID-19, along with reduced retail footfall due to lockdowns and restrictions on travel. The Japanese market performed somewhat better than other regional markets, with bridal jewellery less heavily impacted than most fashion jewellery segments.

The outlook for 2021 for platinum jewellery demand is probably the most uncertain. Consumer confidence in the post COVID-19 environment is expected to gradually be rebuilt, but this will be greatly influenced by the overall economic rebuild, availability of disposable income and a general “feel-good” factor. On balance, the overall risk to platinum jewellery is to the downside.

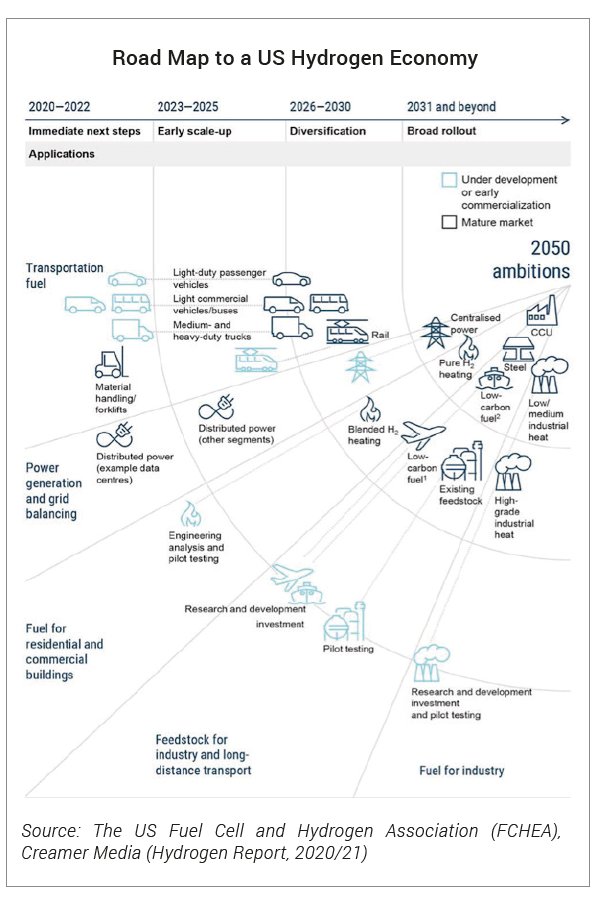

Platinum – A key catalyst for the Hydrogen Economy

As a carrier of energy, hydrogen has emerged as a viable alternative fuel that can be used for heat, powering vehicles, energy storage, and long distance energy transport. This envisaged future, powered by hydrogen, is commonly known as the Hydrogen Economy.

As of early 2021, over 30 countries have released hydrogen roadmaps and governments worldwide have committed public funding in support of decarbonisation through hydrogen technologies. According to the Hydrogen Council, in a report published in collaboration with McKinsey & Company (“Hydrogen Insights 2021: A Perspective on Hydrogen Investment, Deployment and Cost Competitiveness”, February 2021) no less than 228 large-scale projects have been announced around the world and along the value chain.

—————————————————–

|

Platinum’s Voyage of Discovery In 1815, Sir Humpry Davy discovered the phenomenon of heterogeneous catalytic oxidation by inserting a platinum wire near the ignited wick of the lamp. This discovery not only led to the development of the first-ever miner’s safety lamp for use in flammable atmospheres, known as the Davy lamp, but was also the precursor to the use of platinum as an industrial catalyst in many applications that occurred over the last two hundred years.

From early discovery that platinum would catalyse the continued oxidation of coal gas in the Davy lamp, to oxidation of ammonia gas to produce nitric acid – major feedstock for fertiliser, and use of platinum in autocatalysts, new applications for platinum continue to be discovered. Today platinum catalysts remain as relevant as ever as they play pivotal role in the generation of green hydrogen, as well as fuel cells used in fuel cell electric vehicles and many other applications underpinning the fast growing hydrogen economy. |

—————————————————–

These include large-scale industrial and transport applications, an integrated hydrogen economy, infrastructure, and giga-scale production projects. If all of those announced projects were to come into fruition, total investments will reach more than US$300bn in spending through 2030. Of this investment US$80bn is within projects that have already started, i.e. have passed a final investment decision, or are under construction, already commissioned, or operational.

These include large-scale industrial and transport applications, an integrated hydrogen economy, infrastructure, and giga-scale production projects. If all of those announced projects were to come into fruition, total investments will reach more than US$300bn in spending through 2030. Of this investment US$80bn is within projects that have already started, i.e. have passed a final investment decision, or are under construction, already commissioned, or operational.

Transport is widely recognised as leading sector for hydrogen economy. The Hydrogen Council projects that by 2050 hydrogen is expected to power about 400million passenger vehicles, 15 to 20 million trucks and about 5 million buses. During the same time frame, it is envisaged that hydrogen-powered trains could replace up to 20% of the world’s diesel trains and for hydrogen to replace about 5% of the fuel supply for aeroplanes and cargo ships.

Clearly if these projections were proved to be correct, they will have an enormous impact on the platinum market.

Platinum and Fuel Cell Electric Vehicles

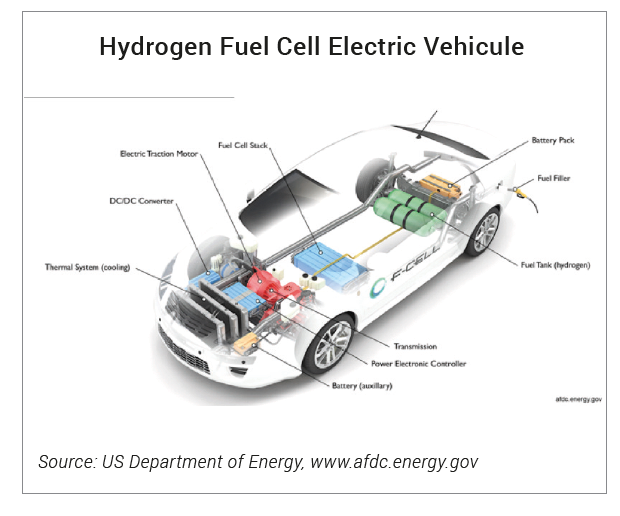

Long-term demand for platinum will be partly influenced by a future makeup of the automobile industry and most importantly, who wins the contest to replace fossil fuels for personal transportation: electricity or hydrogen.

Battery electric vehicles (BEV), which are rapidly gaining market share in developed countries and China, do not require any platinum, palladium or other PGMs. In contrast, a hydrogen engine in fuel cell electric vehicles (FCEV) uses a platinum catalyst as a key component and furthermore it requires about six times more platinum than an internal combustion engine.

—————————————————–

|

|

—————————————————–

A decade ago, when both options were more concept than reality, the hydrogen option seemed to be more advantageous. A car could be filled, in the same manner as with a fossil fuel, compared to the lengthy waiting around time for a BEV to recharge; existing fuel stations could expand to include the hydrogen-filling option and instead of noxious gases, the car would release pure water vapour.

However, to date, the take-up of FCEVs have been much slower then expected. By the end of 2019, only 18,000 hydrogen cell vehicles were sold/leased globally, while by the end of 2018, there were already over 5 million plug-in electric vehicles globally, and sales have been accelerating considerably since then. By May 2020, in the UK only, BEVs had almost 4.3% of the overall car market, representing 131.8% increase since 2019, year-on-year. (Source: Society of Motor Manufacturers and Traders, 2020).

However, to date, the take-up of FCEVs have been much slower then expected. By the end of 2019, only 18,000 hydrogen cell vehicles were sold/leased globally, while by the end of 2018, there were already over 5 million plug-in electric vehicles globally, and sales have been accelerating considerably since then. By May 2020, in the UK only, BEVs had almost 4.3% of the overall car market, representing 131.8% increase since 2019, year-on-year. (Source: Society of Motor Manufacturers and Traders, 2020).

Toyota was one company that truly believed in the hydrogen future from the start. In 2011, it produced the very credible FCV-R concept car that gradually evolved into the Mirai, which became commercially available in 2015. A second-generation Mirai will be released in 2021. Hyundai, a South Korean automaker, is another major backer of hydrogen–powered fuel cell technology and is about to begin development of its H2 XCIENT fuel cell truck in Switzerland. The plan is to grow the fleet of such vehicles on Swiss roads from 50 in 2020, to 1,300 in 2023.

In North America, Hyundai has partnered with Cummins, the 100-year-old engine maker, to develop electric fuel cell powertrains for the commercial vehicle market. Elsewhere, global truck giants Daimler and Volvo are jointly developing fuel cells for their trucks, with the intention of bringing fuel cell trucks to the market in the second half of the decade.

In North America, Hyundai has partnered with Cummins, the 100-year-old engine maker, to develop electric fuel cell powertrains for the commercial vehicle market. Elsewhere, global truck giants Daimler and Volvo are jointly developing fuel cells for their trucks, with the intention of bringing fuel cell trucks to the market in the second half of the decade.

All current FCEVs, including Hyundai’s, can travel up to 400km without the need to refuel, which means they can travel much longer than their battery-only counterparts which only have the capacity to travel around 300km.

So why is then such a slow adoption of FCEVs?

Currently, there are three main reasons slowing wider market penetration of FCEVs: (1) Cost and availability of the infrastructure to support hydrogen fuel cell vehicles; (2) Safety concerns triggered by explosions at production and refuelling stations; and (3) Overall efficiency of hydrogen production.

Compared to BEVs, FCEV are still notably more inefficient. With a BEV, once the electricity is generated, ideally from a renewable source, its supply to the vehicle at the charging location loses about 5%. The charging and discharging of the battery loses another 10%. Finally the motor wastes another 5% driving the vehicle. That makes for a total loss of 20%.

—————————————————–

|

Many Shades of Hydrogen The World Energy Council (WEC) states that there are different groups of hydrogen production, depending on how clean is production. Gray – Hydrogen production emits CO2 Blue – Production of hydrogen creates CO2, but CO2 is captured and stored. Green – Produces hydrogen from renewable energy sources and there is no CO2 emission at any stage. Turquoise – Hydrogen is produced from natural gas of pyrolysis (low emissions) Pink – Hydrogen is produced using nuclear energy or biomass. |

—————————————————–

With a hydrogen fuel, the grand total loss is around 62%, i.e more than three times that of a BEV. In other words, for every kW of electricity supply, a BEV gets 800W, whilst a FCEV gets only 380W – less than half as much. Additionally, this does not take into account that 95% of hydrogen is currently generated from fossil fuel sources.

Despite these current disadvantages, hydrogen still has niches where its primary strengths – lightness and quick refueling – give it a clear advantage, primarily for heavy-duty, commercial vehicles that need to run for very long periods and distances, and have only short times to refuel.

Fuel cells in heavy goods vehicles (HGV) such as trucks, have a further advantage in as much as they are able to maintain consistent power output even as the load increases, for instance when carrying more weight or going up the mountains. Contrary to the large heavy batteries a BEV would need to carry, which become more or less prohibitive. So for industrial vehicles, hydrogen seems like a more viable option, despite current hydrogen inefficiency.

Palladium: metal of the decade

During the last decade, one metal that stood up to all market challenges and tribulations, and outperformed all other commodities, is palladium. From 2009 and the end of the Global Financial Crisis, pretty much all commodities rallied into 2011, with some reaching new price highs. Over time, most retracted or stagnated at best, but only palladium held onto those gains and continued to climb. This stellar performance continued into 2020. The palladium market remained in a significant deficit, driving the price to all time highs. Like with platinum and rhodium, these extreme price movements were principally a result of the tightening of emissions legislation, increased gasoline vehicles sales and limited supply.

From its humble beginnings in the 1970s and 1980s, the palladium market has grown to over 11 million ounces in 2019, mainly as a result of it being a substitute for platinum in autocatalysts. Moreover, supply remained constrained. Russian state stocks had dried up, whilst underlying global primary supplies has hardly changed and new mines have not come into production as yet.

—————————————————–

|

Palladium is a rare and lustrous silvery-white metal that resembles platinum. It is named after Pallas, one of Giants in the Greek mythology, who was killed in the Battle of Giants. It is the least dense and has the lowest melting point of the platinum group metals. |

—————————————————–

- Despite demand for palladium contracting sharply, the palladium market remained in deficit in 2020.

- Like other PGMs, primary supplies were hit by mine closures and processing outages, with autocatalyst recycling also being lower.

- A decrease in vehicle sales was partly offset by higher palladium loadings on gasoline vehicles.

- Consumption in chemical catalysts remained strong, with continuous investment in new plants in China.

- Jewellery and investment demand were significantly lower, with further redemption of palladium ETFs.

Palladium gained its current importance by a combination of two factors: steady growth of global car sales and the tightening of emissions legislation.

Global Car sales almost doubled in the period from 2009 to, while over the same period many countries around the world introduced stricter emissions controls, requiring heavier loadings of PGMs in autocatalysts.

The rise of China has significantly added to palladium and platinum demand. As a predominantly gasoline reliant market, higher car sales combined with increasing catalyst loadings, have positioned China as a top palladium user, overtaking the US in 2005 and exceeding 2m ounces in 2016.

Palladium supply: more geographically dispersed than platinum, but more sporadic

Palladium production is geographically dispersed, contrary to the other PGMs, whereby resources are more concentrated in Southern Africa. Currently palladium is produced in significant quantities on three continents, with the bulk of supply coming from Russia, the USA and South Africa.

During 2020, mines in Russia and the USA were generally less severely affected by the pandemic, partly because they are more mechanised and less labour-intensive than ones in South Africa; and partly due to less strict-government-imposed lockdowns. Norilsk Nickel has reported no significant COVID-19 related disruption at its Russian operations. Nevertheless production in the nine months to September 2020 fell by 8% due to the depletion of surface materials.

Sibanye-Stillwater’s Montana operations in the USA have also operated continuously throughout the pandemic, although there has been some impact on productivity, and some expansion activities have been deferred. Elsewhere in North America, there was some disruption to mining operations. For instance, in Canada, the Lac des Iles palladium mine (Impala Canada) and the Raglan nickel operation (Glencore) were closed for several weeks during the first epidemic wave.

By contrast, supplies from South Africa were sharply down due to COVID-19 related shutdowns as well as a series of outages at the Anglo American Platinum converter plant. Nevertheless, compared to platinum and rhodium, the decline in palladium mine production was smaller, at around 15% (vs. 17% decline for platinum and 20% decline for rhodium).

Secondary supplies were equally affected and down 8% for the year, reflecting temporary interruptions in the collection and transportation of catalyst scrap, and a steep fall in new vehicle sales that has caused an underlying fall in the number of vehicles being retired.

Palladium demand

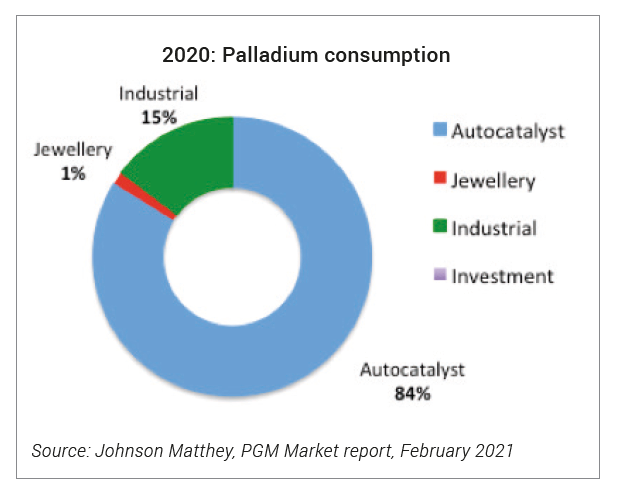

More than 80% of palladium is used in catalytic converters, with the balance going to industrial applications, jewellery and investment.

Autocatalyst demand

Palladium consumption in the automotive industry has two main drivers: sale of autocatalysts through new vehicle sales and PGM loadings. The catalyst formulation and loading used, vary from one vehicle to another, based on the engine’s control, the relevant emissions control legislation, the engine’s size and where it is positioned in the car.

Palladium consumption in the automotive industry has two main drivers: sale of autocatalysts through new vehicle sales and PGM loadings. The catalyst formulation and loading used, vary from one vehicle to another, based on the engine’s control, the relevant emissions control legislation, the engine’s size and where it is positioned in the car.

Worldwide, PGM content averages around 4 to 5 grams per car, but the range is much wider – from 1 g on micro-cars, to 15 g or more for larger and more powerful vehicles. Most gasoline-fuelled vehicles use a combination of palladium and rhodium as the catalytic metals, but a number also use platinum.

It is estimated that almost seven times as much palladium as rhodium is used for autocatalyst applications globally. By contrast, in diesel vehicles, although the catalyst loading and catalyst size vary greatly, the metal formulation varies little, being mainly based on platinum or platinum-palladium.

—————————————————–

|

Real Driving Emissions (RDE) Tests During RDE testing, vehicles are driven according to random acceleration and deceleration patterns, intended to replicate the wide range of operating conditions that cars might experience during a lifetime on the road. A valid RDE test can vary within these broad parameters, making the stringency of third party testing unpredictable; which means that automakers must ensure that emissions control equipment remains effective under most conceivable operating conditions. |

—————————————————–

During 2020, globally all regions saw increases in the palladium content of gasoline after treatment systems, with largest gains occurring in Europe and India, reflecting the rollout of the Euro 6d and Bharat VI legislations.

It is estimated that in Europe, the introduction of the full Euro 6d legislation and Real Driving Emissions (RDE) testing has increased PGM loadings considerably, requiring 40-50% more palladium than the comparable Euro 6 (pre-RDE) models. It is a similar situation in China with the China 6 legislation and its more stringent variant the China 6b and in India, where the average palladium content of gasoline car rose by more than 10% in 2020.

Industrial demand

Industrial usage of palladium ranges from electronics, dentistry, medicine, hydrogen purification and chemical applications.

During 2020, among palladium’s industrial applications, consumption of palladium in the dental sector was particularly hard-hit. Dental procedures during the pandemic were seen as particularly dangerous for the practitioner, because of the risk of virus transmission via both droplets and aerosols. As a result, palladium dental consumption was down 30% in 2020.

Palladium consumption in the electronics sector had a solid rebound following the initial drop during the first half of 2020. Remote working practices and “wider stay at home” initiatives led to the increased sales of laptop computers and games consoles, while the rollout of 5G telecommunications technology also acted as a positive driver palladium consumption for electronic components.

However, demand for palladium from the chemicals industry remained remarkably robust throughout 2020. Continuing expansion of the Chinese petrochemical industry led to the increased purchasing of palladium catalysts. This was primarily driven by the self-sufficiency and modernisation objectives in China’s thirteenth Five-Year Plan that concluded in 2020.

The palladium market is much less dependent on investment and jewellery demand. Consumption of palladium jewellery is insignificant, while investment has been negative for several years. By early December 2020, under 540,000oz of palladium remained in ETFs. Even if all this metal were sold in 2021, it would probably not be enough to bring markets back to a balance.

Platinum-palladium substitution

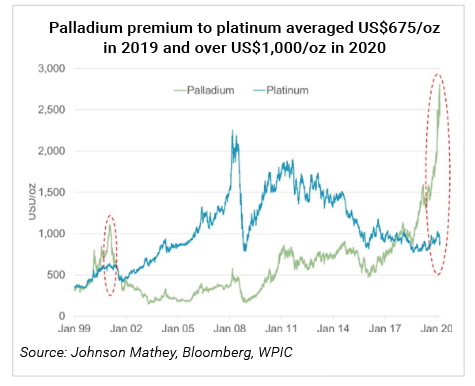

The patterns of use for platinum, palladium and rhodium in autocatalysts have varied over time, determined by different factors including the effectiveness, availability and price of each metal. In recent times, the automotive industry has seen notable substitution of platinum for palladium, mainly driven by sustained palladium deficits and the high price of palladium (still over US$1,000/oz higher than platinum).

For instance, the China 6 regulation has resulted in an increase of around 40% in palladium loadings and required between 50% to 100% more of rhodium, which triggered increased substitution of platinum for palladium. Given that only a 5% substitution represents 450,000oz, this trend will have a meaningful impact on platinum demand in the coming years.

Battery electric vehicles vs. Fuel cell electric vehicles – modern “Battle of Giants” that might slew “Pallas” aka palladium again

For a number of different reasons as discussed before, battery electric vehicles (BEVs) are gaining bigger market share versus fuel cell electric cars (FCEV). It is still too early to call it mass adoption and certainly battle for primate between BEVs and FCEVs is far from over. With most recent commitment and mega investments around the world in hydrogen storage and hydrogen infrastructure, FCEV still have a strong chance to play a major role in a future transportation landscape. However, the fact that more than 80% of palladium is used in autocatalysts, and BEVs are emission-free and do not use the catalyst at all, casts a fair amount of concerns over palladium long term future.

However, one thing is apparent though: with palladium-containing vehicles representing over 70% of the total light-duty vehicle production, there is no short circuit for a palladium demand as yet. Immediate to medium term future of palladium is safe and bound to be bright and expensive.

Rhodium: a scramble for metal continues

—————————————————–

|

Rhodium is one of the rarest and most valuable precious metals. Its is silvery-white, hard, corrosion-resistant, chemically inert transition metal. It is found in platinum or nickel ores together with the other members of the platinum group metals. The name is derived from the Greek ‘rhodon’, meaning rose coloured and named for the rose colour of one of its chlorine compounds. |

—————————————————–

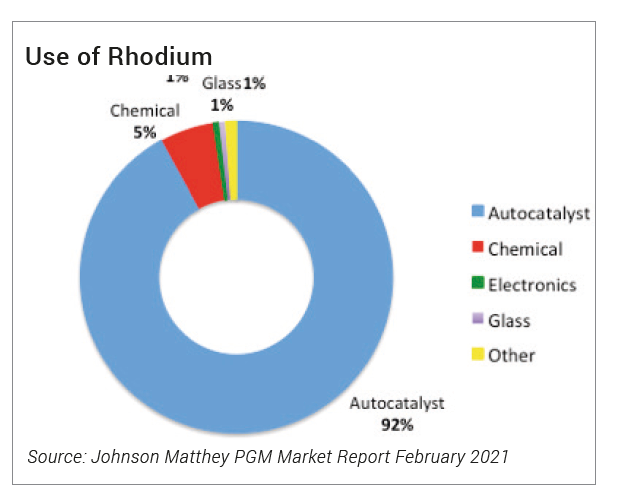

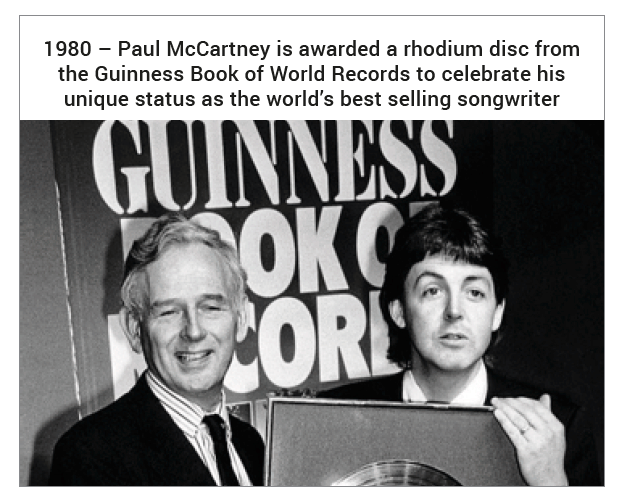

Rhodium has seen extraordinary price movements over the last two years, rising from below $3,000 per ounce in January 2019 to $17,000 per ounce at the end of December 2020 and continuing to achieve new highs of $27,000 per ounce by March 2021. Like with platinum and palladium, these extreme price movements were a result of tightening emissions legislation and supply interruptions, but also due to some factors unique only to rhodium. It has a handful of industrial applications, but unlike platinum and palladium, rhodium is far less amenable to substitution, because of its unique chemical and physical properties.

- The rhodium market deficit doubled in 2020, as a contraction in primary supplies greatly exceeded falls in autocatalyst and industrial demand.

- Tightening emissions legislation helped limit the decline in autocatalyst demand to under 10%, significantly outperforming light vehicle production (down around 16%).

- The rhodium price surged to an all-time record high of US$27,000 per ounce in March 2021.

Rhodium’s principal use is as one of the catalysts in the three-way catalytic converters in automobiles and to a lesser extent, in electronics, chemical and glass applications. With the exception of the glass sector, which can be more flexible in its rhodium usage, by varying rhodium content of the platinum-rhodium alloys used in glass-making equipment, rhodium demand is pretty inelastic.

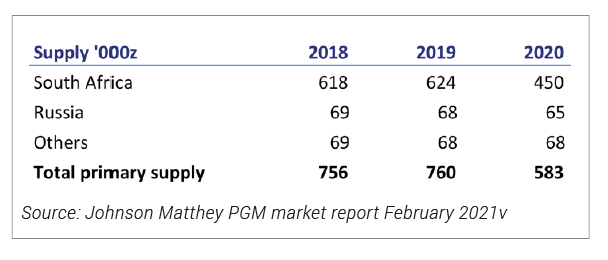

Like with most PGMs, rhodium supply is highly concentrated in South Africa, particularly in the UG2 reef, which has an unusually high rhodium grades, compared to other places. Most UG2 ore is extracted from underground mining operations, often at considerable depth, using labour-intensive mining methods. Rhodium supplies were heavily affected by disruption at South African mining and processing operations throughout 2020.

Like with most PGMs, rhodium supply is highly concentrated in South Africa, particularly in the UG2 reef, which has an unusually high rhodium grades, compared to other places. Most UG2 ore is extracted from underground mining operations, often at considerable depth, using labour-intensive mining methods. Rhodium supplies were heavily affected by disruption at South African mining and processing operations throughout 2020.

By far the biggest use of rhodium is in the automotive industry

Although used alongside palladium to absorb harmful emissions such as nitrogen oxides (NOx) from car exhausts, rhodium remains far superior and the best catalyst for aftertreatment of gasoline NOx emissions.

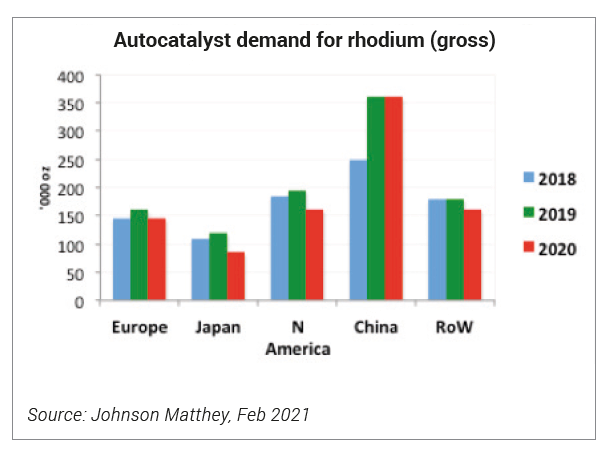

With NOx emission limits continuing to tighten in major global markets, rhodium loadings on gasoline vehicles have risen significantly over the past three years and will continue to grow. Loading increases have been especially significant in Europe and China where the implementation of Real Driving Emissions (RDE) testing, under the Euro 6d and China 6 legislations, has led to significant loading increases.

This has been a positive for demand for all the autocatalyst PGMs, but the impact has been greatest for rhodium, because RDE focuses on NOx emissions. According to Johnson Matthey, the average rhodium content of a light gasoline vehicle in 2020 was up by nearly 10%, versus the previous year, and by more than 40% since 2017.

These loadings gains were partly offset by steep declines in light vehicle output, leaving the world’s autocatalyst consumption down by less than 10%. This fall in demand was prevalent in the first half of the year, with a collapse in Chinese car output in February 2020, and in major Western auto markets in March and April. However, a steep recovery in vehicle production, particularly in China, gradually absorbed any surplus liquidity, and yet again rhodium availability came under intense pressure, driving the price to a series of all-time highs.

Furthermore, after years of under-investment in new mines in South Africa, the rhodium market is expected to remain in a deficit for years to come. It is estimated that by 2025, the global supply gap could be up to 235,000oz, out of a total market of 1.37million ounces. As a result, high rhodium prices are expected to continue for the foreseeable future.

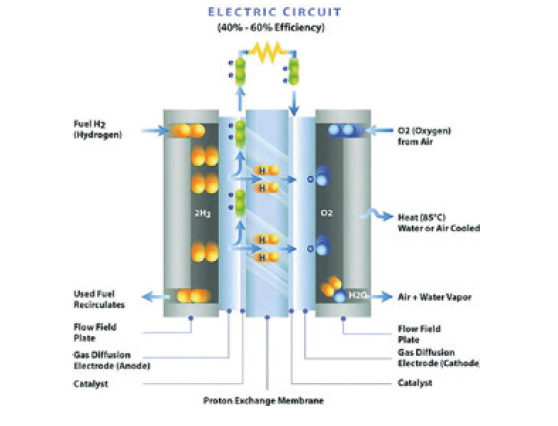

In the process known for over 100 years, electricity is produced by joining hydrogen (the fuel) and oxygen (air) using a proton exchange membrane (PEM), which is coated with a platinum catalyst, at zero combustion.

In the process known for over 100 years, electricity is produced by joining hydrogen (the fuel) and oxygen (air) using a proton exchange membrane (PEM), which is coated with a platinum catalyst, at zero combustion.