Copper: The future is green

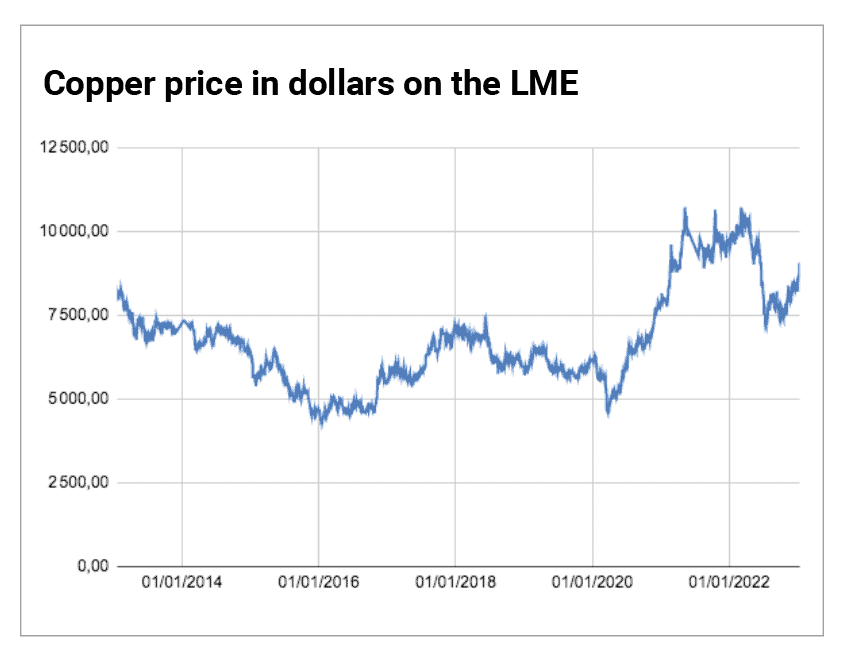

Structural demand growth tied to decarbonization combined with limited supply development is expected to result in large copper deficits. Robin Bhar, respected consultant in mining and metals, explains why there is an urgent requirement to launch new projects and to allocate sufficient capital to finance them.

Put simply, the energy transition starts and ends with metals. If you want to generate, transmit, distribute, or store low/no-carbon energy you need metals. Most metals will be needed for the energy transition, but copper is vital to our transition to a more sustainable future and to maximize the potential of this transition to a greener future. The rapid deployment of clean energy technologies implies a significant increase in demand for a critical mineral such as copper. Renewable energy technologies use four to five times more copper than fossil fuel power generation. Electric vehicles (EVs) use up to four times more copper than internal combustion engines. Copper consumption associated with EVs, and renewable energy technologies is set to grow rapidly, according to the World Bank. The growing need for grid expansion will underpin a doubling of annual demand for copper by 2040, the IEA said.

The green agenda aims for a major advance in EVs, a transition to alternative fuels for aviation, big changes in how homes are heated and insulated, the ending of single-use plastics and much else. The biggest growth sector will be EVs – a 2oC or lower pathway will see demand soar, with global sales of zero-emission cars rising from 4% of the market in 2020 to 70% by 2040.

Projected copper demand is subject to considerable uncertainty. It is highly dependent on the stringency of climate policies (ambition and actions), but also on different technology development pathways. Grid operators have long been working to reduce raw material costs. One option is to switch from copper to more affordable aluminium. However, it is challenging to substitute due to its superior performance in electrical applications. Extensive literature review, and expert and industry consultations suggest copper demand will grow significantly over the coming decades. It seems that copper usage, in China at least, is now finding an extra driver in the form of government investment in green transition technology. Additionally, infrastructure developments in major countries and the global trend towards cleaner energy and EVs will continue to support copper demand in the longer term. Over the next 28 years, total copper demand is set to match cumulative copper consumption since 1900.

Where is the supply?

The prospect of a rapid increase in demand for copper – well above anything seen previously in most cases – raises huge questions about the availability and reliability of supply. Today’s supply and investment plans for copper fall well short of what is needed to support an accelerated deployment of solar panels, wind turbines and EVs. More than $1tn of investment will be needed in key energy transition metals over the next 15 years just to meet the growing demand of decarbonization if global warming is to be kept to less than 2oC by 2050. This is almost double the figure invested over the previous 15 years.

Peak copper production

Peak copper production

The copper mining sector operates either in difficult places, riskier jurisdictions, faces a lack of infrastructure or years of opposition to development. The underinvestment in copper supply over the past decade has resulted in muted growth in project pipelines. The difficulty of finding new deposits adds to the challenge of ore scarcity. As grades decline, miners are also increasingly investing in underground mines to increase production even though the cost of production is higher in an underground operation.

Mines currently in operation are nearing their peak due to declining ore quality and reserves exhaustion. Declining ore quality exerts upward pressure on production costs, emissions, and waste volumes. Mines in many regions are exposed to high levels of climate and water stress. For example, the world’s largest copper mine, Escondida in Chile, appears to have reached a peak and its production in 2025 is expected to be at least 5% lower than today. Beyond the near term, few projects are planned to start operations in the late 2020s, while output from existing mines is expected to contract further due mainly to declining ore quality. For example, the average copper ore grade in Chile declined by 30% over the past 15 years. Meeting rising demand in the longer term would require continued new project development. Recycling relieves the pressure on primary supply but would not eliminate the need for continued investment in new supplies. Mining assets are exposed to growing climate risks. Copper is particularly vulnerable to water stress given its high water requirements. Over 50% of today’s copper production is concentrated in areas with high water stress levels. Several major producing regions are also subject to extreme heat or flooding, which pose greater challenges in ensuring reliable and sustainable supplies.

Mining companies remain cautious about committing significant capital to new projects; this is largely because of uncertainties over the timing and extent of demand growth – linked to questions about the real commitment of countries to their climate ambitions) as well as the complexities involved in developing high-quality projects. Other factors include permitting issues and shifting political landscapes.

Spending more, discovering less

Recent analysis of the exploration sector’s efforts to find and define major copper discoveries reveals a marked lack of success – particularly over the past decade and despite rising copper exploration budgets in recent years. Only a dozen major copper discoveries were identified between 2012 and 2021, compared with 82 between 2002 and 2011. Such operations, and many potential new mines, will also face rising, or environmental, social and governance (ESG), scrutiny, which will likely limit the number of deposits – regardless of size – available to the global mined copper supply pipeline.

New mine projects as well as the capital is needed

Major mining companies are increasingly risk averse but increasing mine supply is challenging given heightened country and operational risks and the industry remains wary of multi-billion dollar investment decisions. Resource companies are taking a more disciplined approach to capital management. Rather than growth at any cost, senior management are focussing on improving shareholder returns and are increasingly handing the excess cash back to shareholders. Current estimates for this year’s capex spend are at $270bn, up 4.7% YoY. The capex cycle normally results in a similar change in supply. The peak in copper industry capex in 2012 saw mine supply growth peak the following year. However, growth over the 2013-2016 period averaged 5%. Only two major copper mines were brought on stream between 2017 and 2021.

The outlook for the capex cycle looks challenging. Central banks are raising interest rates to tame inflation, which will raise financing costs for resource companies. This comes as many producers are facing rising costs. The surge in energy prices has started to ripple across the sector. In Chile, miners are facing higher taxes and royalties as the government looks to fund social spending programmes. Increased focus on ESG management means implementing better waste eradication and progressive labour policies as well as increasing the complexity of the regulatory environment.

Conclusion

The demand outlook for copper is bullish, as it remains a key ingredient in the energy transition. Miners have to plan for the considerable challenges of this decade, including the urgent need to address the prospect of acute labour shortages, a legacy of underinvestment and sparse project pipelines, geopolitical risks, and low productivity. Today’s investment plans are geared to a world of gradual change; given long lead times for new projects, an accelerated energy transition could quickly see demand running ahead of supply. Structural demand growth tied to decarbonization combined with limited supply development is expected to result in large supply deficits. There is an urgent requirement to launch new projects and the need of capital to finance them.